Welcome to the 8 new crew members who have joined the frontier expedition since the last letter! If you haven’t subscribed, join the 54 curious explorers in our adventure to understand the frontier of innovation.

Today's journey covers 4,000 words of innovation, exploring how apps add value to crypto, diving into three revolutionary projects, and exploring Cardano's updates since its peak. If you're intrigued by web3 and Cardano, subscribe and share with friends. Enjoy the adventure

Exploring the unknown often begins with a spark - inspired by an intriguing book, an insightful podcast, a text exchange with a friend, your social feed, or an unexpected yet mesmerizing occurrence. After exploring a domain long enough, the initial spark is sometimes forgotten or made secondary. Those researching crypto for years, building or observing, may have moved far from the initial spark - which, for many, was and is an allure of profit.

I have discussed why Cardano will be one of the best crypto protocols in The Cardano Paradigm. While my preference is discussing the technology and its enduring impact, I, too, took the leap in excitement of high returns back in 2021.

I am writing this for all of those on your crypto journey, wherever it may be, to bridge the gap for you today between promises of returns and the underlying technology. ADA, Cardano's native token, stands out as a prime investment, driven by its undervalued, revolutionary projects and significant protocol upgrades post-all-time high. These elements enhance Cardano's utility and adoption potential and position it uniquely in a competitive market, promising high potential returns for informed investors.

This is a ride for everyone to jump along on - If you don't know much about blockchain technology, or you know plenty, you're a Cardano-maxi or a naysayer, there's one language that I will speak today, that I know to be universal - that is the language of making money.

Today, we'll delve into the application effect on the underlying protocol, demonstrating how projects built on Cardano impact the platform. We'll then explore three revolutionary Cardano projects and conclude with an overview of Cardano's evolutionary changes.

As a reminder - Today is a journey through technology and what it does for the financial position of Cardano. While the allure of financial gains cannot be understated, the sophisticated technology and the vibrant community behind Cardano present a more sustainable foundation for value - today, I hope to bridge the gap between all of these.

Applications Effect on The Underlying Protocol

The Fee Effect

Blockchain protocols, such as Cardano, are digital lists of transactions; the list is validated by anyone who chooses to participate; participating takes some commitment from the entity, computational power, or money, and the incentive to participate is a payout in that blockchain protocol's cryptocurrency.

Blockchains like Ethereum and Cardano made it possible for developers to program using the underlying infrastructure as a base. Apple's app store is a rough analogy for how this is structured. IOS app developers make apps and put them on the Apple store. Apple takes a fee because they have provided the infrastructure required for that company to develop and create the app for Apple users.

Similarly, developers can create applications using Cardano's, Ethereum's, or Solanas's blockchain. The analogy breaks down because Cardano operates on a decentralized model, where no single entity controls the platform or takes a fee from the applications built upon it. Instead, the protocol is maintained by a network of participants, incentivized through transaction fees and network rewards, ensuring the blockchain's integrity and functionality.

Recall that blockchains are digital lists of transactions. Building on Cardano means that people who use those apps are recording their transactions on the Cardano blockchain. Doing so requires a fee, as it does on all blockchains, so that people validating the list of transactions are incentivized to do so. The fee is paid in the blockchain native token, which in Cardano's case is ADA.

For instance, consider a user executing a smart contract on a Cardano-based decentralized application (dApp going forward) to lend out ADA in a decentralized finance (DeFi) application. This action incurs a transaction fee, payable in ADA, compensating network participants for processing and validating the transaction.

Every blockchain handles this differently, and the technicalities of how fees are managed can get quite nuanced from chain to chain. However, the basic premise stands:

To use a dApp, you need to pay a fee in the blockchain protocol's native token, which means that the logical reasoning follows: An increased demand for a dApp = increased network activity requiring transaction fees = increased demand for the use of the native token = increase price assuming supply is constant.

I'm not going dive into too much detail on the technicalities of the fee structure (a good resource on Cardano's fee structure), as the above logical reasoning stands, regardless of the specific structure and setup.

I know some of the Cardano savvy readers are asking: What about babel fees? Aren't those negating the need for ADA to pay for transactions? The reality is that transaction fees in the ledger are denominated in ADA according to a function fixed as a ledger parameter; Babel fees create the possibility to pay in different projects native token, increasing user experience, but on the backend, are creating liabilities that are fulfilled by liquidity providers of ADA who are willing to match the babel fee transaction.

This section means that the more users are driven to a dApp on a blockchain protocol, the more that blockchain protocol's crypto will benefit.

Let's look at a more indirect but equally important driver of value: network effects.

The Network Effect

A less direct but equally important aspect of new dApps introduced on a blockchain protocol is the network effects they drive to the protocol.

Not Boring's "Small Applications, Growing Protocols" explores this in depth. The idea is that small apps with a brief explosion in popularity can partner with protocols because while the apps may fade, the user base is now captured in the protocols. Basically, apps build on a specific protocol and blow up because of popularity; when the hype dies down, they're not stranded in a desolate desert; they've emerged into a protocol with a vibrant ecosystem.

This transition into Cardano's ecosystem, much like stepping out of Vault 101 in 'Fallout 3,' marks the beginning of an expansive journey. In the game, what seems like a desolate wasteland at first glance reveals itself to be a world rich with communities, economies, and untapped opportunities. This perfectly parallels the experience of delving into Cardano's ecosystem.

Initially attracted by a few standout dApps, users soon discover a thriving network of projects and innovations. Just as the wasteland wanderer in 'Fallout 3' finds that the world outside Vault 101 is far from empty, newcomers to Cardano realize the ecosystem is bustling with activity and potential, far beyond the initial attractions. This rich, unexpected depth retains users and draws new ones, reinforcing Cardano's network effects and underscoring the protocol's burgeoning value.

Not only will Cardano's apps bring direct fee revenue, but I think that the revolutionary nature of some will bring a massive set of new eyes on the ecosystem, which will drive the demand for ADA up as more people come to understand and see how well developed and excellent the ecosystem is!

Not only do Cardano's applications promise direct fee revenue, but the groundbreaking nature of some projects is set to captivate a broad audience, potentially boosting ADA demand as the ecosystem's development and excellence become increasingly apparent.

From zero live projects at ADA's peak in September 2021 to 157 as of February 5, 2024, Cardano's transformation is undeniable.

Next, we'll delve into three revolutionary projects in ebook and publishing, cloud storage and computing, and telecommunications—each poised to redefine their sectors and underscore Cardano's value proposition.

Three Revolutions: Books, The Cloud, and a Phone Call

Cardano has many examples of projects that will profoundly impact the crypto markets. People typically talk about decentralized finance when discussing cryptocurrency and blockchain use cases. While Cardano certainly has a robust set of Defi dapps, I will take you through a journey of use cases that will be way more familiar, relevant, and practical! Let's start with one that makes blockchain technology's benefits widely apparent.

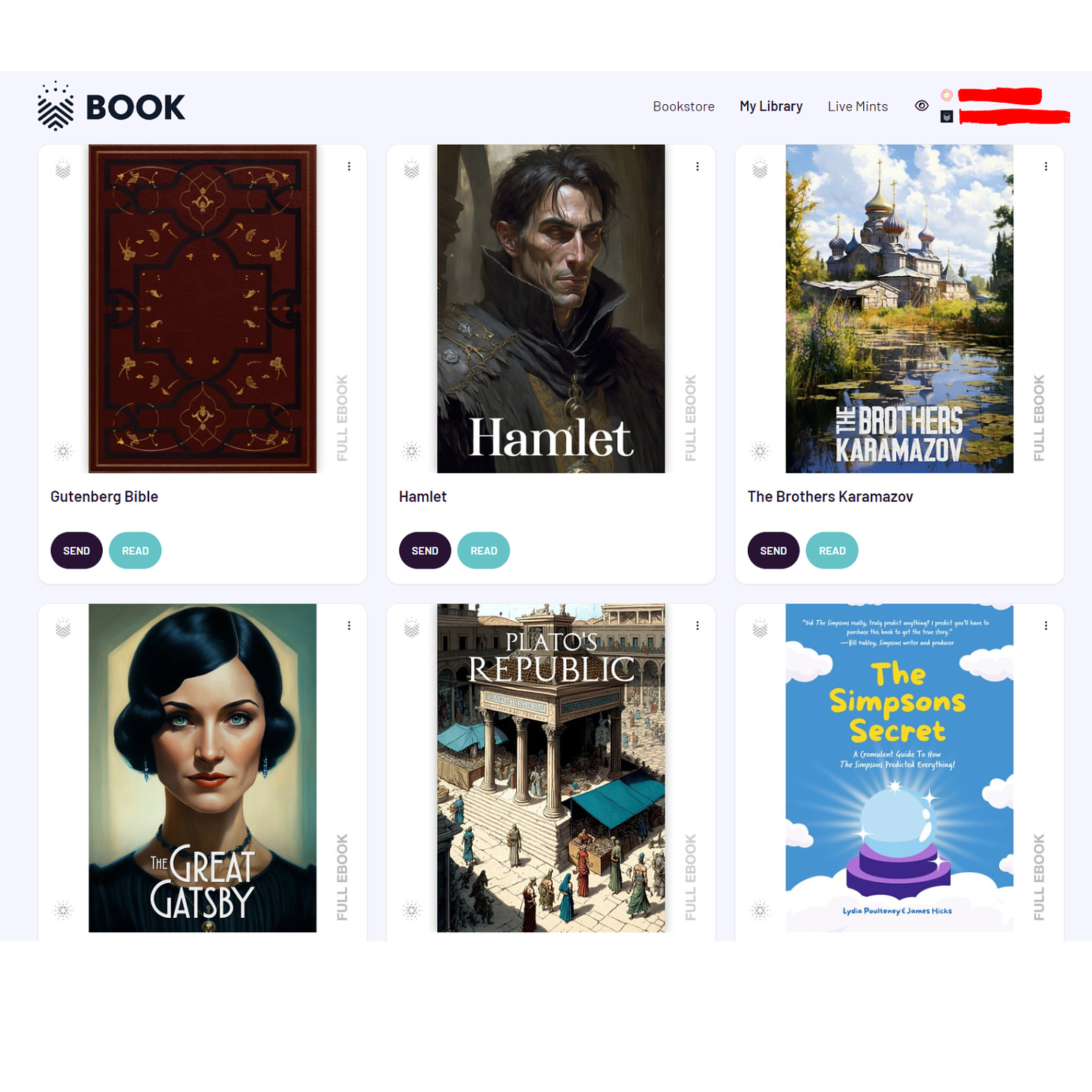

BOOK.IO

Your favorite author has just come out with a new book, and you couldn't be more excited. You're so thrilled you are preparing to order physical and digital copies of the book! One is for your library, one is for your Kindle, and one is for your phone as an audiobook.

This path inevitably leads you to Amazon, where you can conveniently purchase the book that is now part of your Kindle library! Exciting, you can read the book! And that, you do. You finish it the first day it comes out… Okay, now what? I guess you can reread it, but can you sell it back? Can you rent it out? Is it possible to put it on a "virtual bookshelf" that can be viewed by your friends, family, and other digital social followers?

No, what I mentioned probably sounds strange, to say the least, because it's a digital book.

When you purchase a digital copy of a book from Amazon, they open up a section of their database for you to view, which is the copy of the book you purchased. You're being given a license to access content, but Cardano's Book.IO has different plans for you!

Book.IO is revolutionizing the consumer book and publishing industry, as stated in the abstract of their whitepaper:

"Consumers lack true ownership of their digital books (eBooks or Audiobooks) since they unknowingly purchase a "license to access content" rather than the actual content. This means they cannot sell, give away, or lend their books. Retailers, Publishers, and Authors retain the power to alter or remove content without notifying the purchaser. Moreover, if a consumer cancels a centralized service, they lose access to their purchased digital library. The digital book industry is nearly two decades old and both the licensing terms and the technology infrastructure are antiquated. Consumers now seek ownership of their digital assets. Book.io introduces Decentralized Encrypted Assets (DEAs), establishing genuine digital book ownership and revolutionizing the industry for both consumers and creators."

Rather than given access to the digital content, you are BUYING the digital content, which sits nicely in your crypto wallet. The fun continues; what's the use of having a book in your crypto wallet if you can't read it? Book.IO created a straightforward, easy-to-use, and functional e-reader app for your phone!

With this innovation by Book.IO, there are now markets where you rent out books you purchase or sell them back! In a virtual reality world, I'm sure we'll reach a point where you can display your digital books on your bookshelf for all to see! It also negates the fear of worrying about books being banned and canceled since a book in a self-custodial wallet cannot be taken from the user once they have it.

From an Author's perspective, the sales % you receive is SIGNIFICANTLY better than going the traditional publisher route. Authors will get 70% of sales. Additionally, royalties on secondary market sales will go to authors, as this can be integrated into the NFTs. They also have a suite of marketing tools at their disposal to market their creation if they decide not to take traditional publishing avenues.

Book.IO makes the promise of blockchain technology apparent outside of the finance industry. It is a use case that can potentially onboard many individuals who may not care about crypto and Defi but find their way into it because of their love for knowledge.

BOOK.IO has a strong team with tremendous experience in this industry and has previously created and sold an eBook platform and distribution company with over 6,000,000 registered users. Also, with famous investor Mark Cuban on board, this project has so much going for it that I have a hard time seeing anything but spectacular results.

Our first example will disrupt the ebook industry; the question remains: by how much? I think significantly, which is excellent for the eBook industry, Book.IO, and Cardano.

Our next example takes us to a massive industry with projections of a market value of $470 Billion: the cloud storage and computing market.

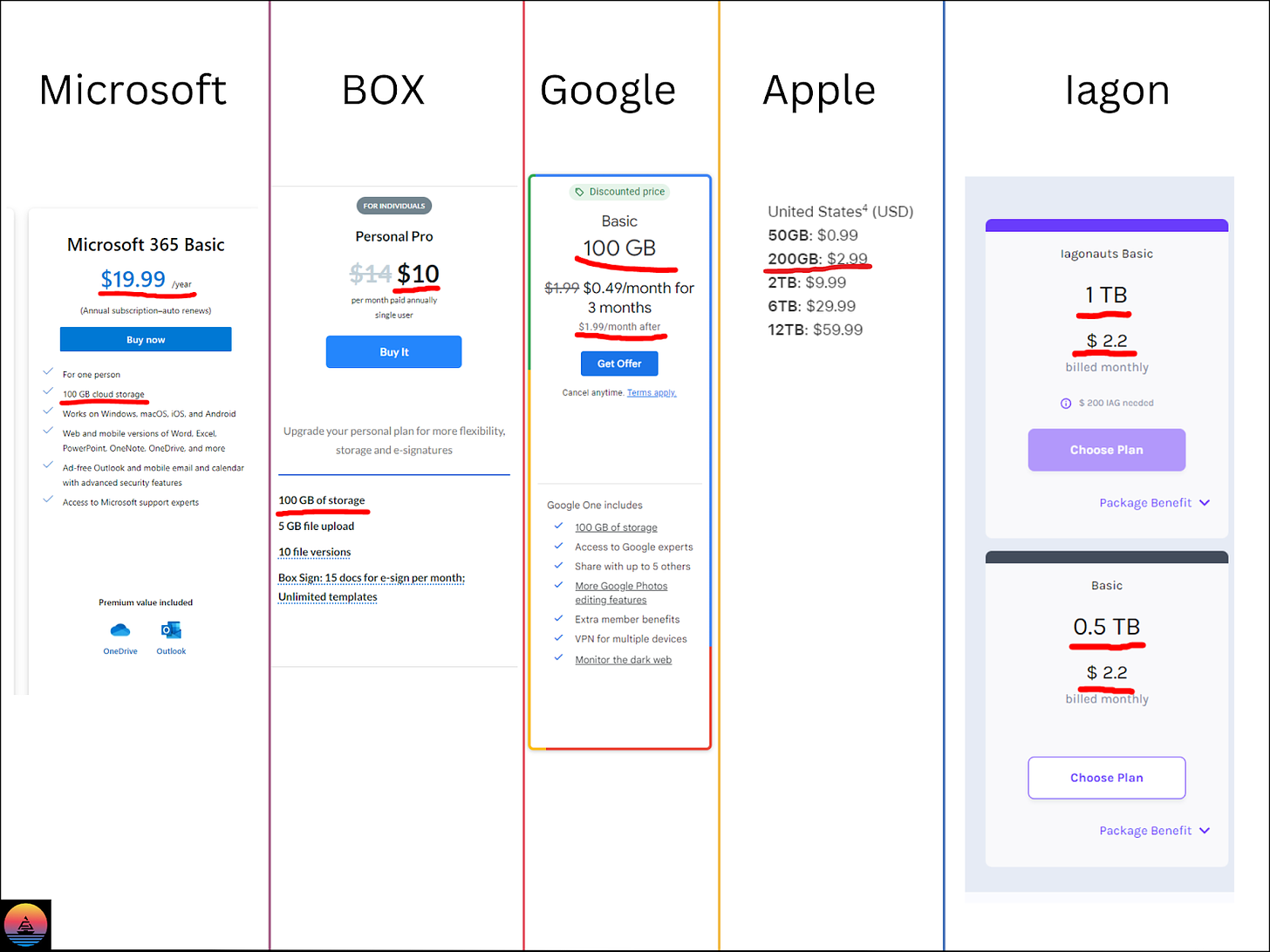

Where Book.IO will compete with Amazon's Kindle, Iagon competes in the ubiquitous 'Cloud' space and climbs its way to AWS, Azure, and Google Cloud.

Iagon

The only way to start by talking about cloud storage and computing is in your... dentist's office... 🤔

The origin of Iagon was not because the project's founders were looking for better money but because they were looking for a better way to secure medical records. It started with the ambition to create a secure way for individuals to hold and thereby own their health data and interact more effectively with health services. The functionality inevitably expanded to ALL data that can benefit from being stored by the owner securely and decentralized.

Iagon aims to build a marketplace for decentralized storage and computing resources, and much like Book.IO, it revolutionizes various aspects of its industry. As stated by the team, it will make storage and computing more secure and decentralized, offer more data privacy and compliance, reduce costs, AND allow users to monetize their own data if they wish.

Have you ever wondered why Facebook, Google, and [insert any social media based on an advertising business model] can profit from your preferences, likes, and dislikes through highly precise targeted advertising without you knowing or getting a cut?

By leveraging blockchain technology, there will be more transparency around what is happening with your data so that your data being tracked doesn't fly under your radar. Additionally, since the architecture in which your data is being stored is not centrally operated, your data will not be tracked without your consent and without you getting a cut of the profits.

One of my favorite things about Iagon is that ON TOP of the benefits of decentralization, data profit sharing, data privacy, and security, it is competitive and mostly cheaper, currently, than the centralized alternatives (for storage), boding well for mainstream adoption.

I understand that the alternatives depicted offer other services along with those storage packages; however, if you were solely looking for storage, Iagon is competitive with some of the largest companies in the world, including Microsoft, Apple, and Google. Iagon is only on step one of its services; it will also include these other services if it continues progressing toward its vision. It's pretty staggering that by using blockchain, it's competitive with these behemoths. Talk about actual utility on display here.

I like the example of Iagon because while more abstract than books, they offer something that most digital natives who come across it will understand: a place to store your digital stuff. Those who use iPhones are familiar with clearing their photos to free up storage and not require payment for more space. Iagon offers a cheap alternative that matches the price and provides notably more storage, ESPECIALLY if you hold Iagon tokens, which gives you access to 1 Terabyte for only $2.2 per month (you must carry $200 worth of the token in your crypto wallet, which you get to keep, by the way)!

How do they do this? Simple, blockchain technology allows entities and individuals to participate in providing spare resources. To simplify, it basically works as follows:

You run an Iagon node (software) and allocate spare storage space resources from your computer to the Iagon network → Providing the space gives staking rewards, and those who sign up are using storage space from the network of providers. Ingenious and possible because of blockchain.

Once again, here is an example of how a revolutionary application sits on Cardano's blockchain - there are so many examples of projects on Cardano, and here's one that alone is a David and Goliath story where David looks like he's got a good shot!

Another industry controlled by a few is being challenged by a project on Cardano - Telecommunications.

That's right, no longer are the days you have to sit with AT&T or Verizon Customer Service for 3 hours - let's take a journey through World Mobile.

World Mobile

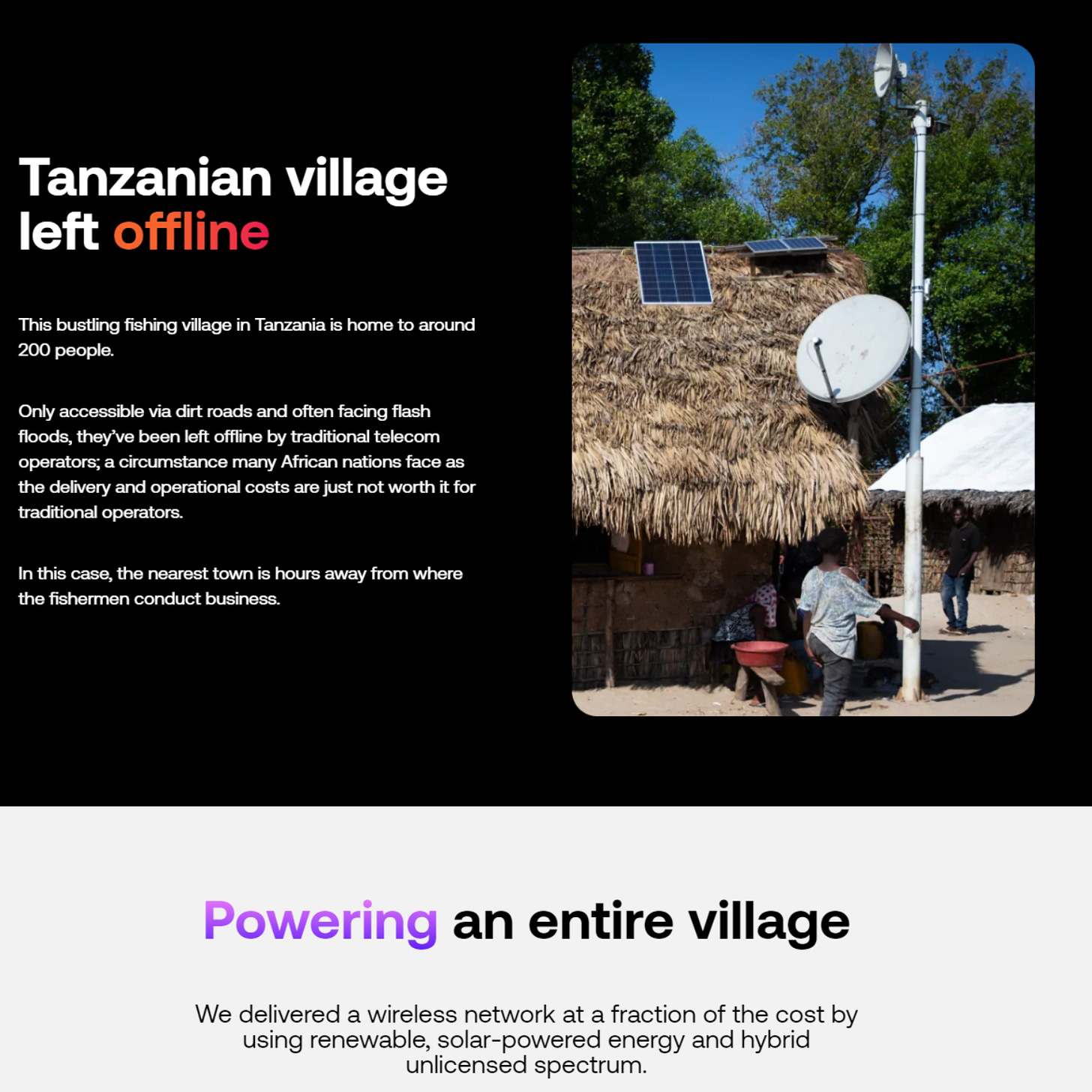

World Mobile is a project leveraging the Cardano blockchain to build a telecommunications network so that the entire world can be connected - while providing the service more cheaply and effectively than current providers. From the abstract of the World Mobile Whitepaper:

"A shared economy model to deliver network infrastructure would enable improvements in efficiencies of network design and operation, as well as provide a more fluid delivery of connectivity to users of a network. The use of blockchain in this model enables the removal of intermediaries and a layer of cost from the delivery mechanism. It also enables the rapid expansion of the network thanks to the transparency provided by smart contracts, which allow the participants to have a provable and guaranteed rewards system. We propose a solution to the global problem that nearly half of the world is still not connected, as highlighted by the United Nations. This solution aims to address the affordability issue, as well as the more efficient use of network resources, to enable connectivity to be provided in a more distributed and decentralized manner."

While World Mobile may not entirely and directly operate on the Cardano blockchain, as telecommunication laws make compliance difficult when using a decentralized and public blockchain, World Mobiles Token (WMT) is a Cardano native token and, therefore, the transactions that take place on Cardano, are paid for in ADA (see our fee conversation above).

World Mobile provides a sharing economy where individuals and entities can sign up to operate one of three nodes: an Air Node, Earth Node, or Aether Node. Air nodes provide coverage and internet access, Earth nodes provide authentication, identity, blockchain internode communication, and telecommunication services, and Aether nodes provide links to legacy telecommunication operators.

While this may seem abstract, let me take you to a small village in Tanzania where this presently operates. The remarkable case study of this small village in Tanzania is a prime example of World Mobile's revolutionary nature.

Simply, the individuals are connecting to Wifi provided by those operating air nodes in this village, the fishermen. The individuals can use the World Mobile app to purchase minutes with their local currency, generating revenue for World Mobile and Cardano through network fees. The individuals are now connected to the web, have a decentralized ID through Atala Prism, and can message friends and make calls locally and internationally.

This is a revolution that cannot be understated. About 2.9 Billion people in the world are not connected to the internet. Some of these World Mobile is tackling in the United States, and for those thinking: "Well what about Starlink? One does not simply bet against Elon," I had the same thought - beautifully explained here - World Mobile will not compete with Starlink; they will be a potential customer for their backhaul services.

World Mobile is yet another remarkable example of a project of a revolutionary nature on the Cardano blockchain.

These three examples highlight more than a simple investment thesis for ADA; they highlight blockchain technology's beautiful and revolutionary nature. This new technology is significantly more than a place for crime; it's where the unthinkable is possible and beneficial for both the creating entity and the consumers.

These three projects can be 5,000-word Frontier Letters themselves, so if I did not cover them to the depth you expected, I left links if you would like to do further research. Remember, these are only 3 of the 157 live projects. I didn't even mention the AI Marketplace, where AI agents will eventually be able to interact with one another autonomously by using a cryptocurrency to pay one another.

While many more projects are on and coming to Cardano (which you will inevitably learn about by subscribing), let's talk about the sleeping giant itself and what it's been up to since September of 2021.

Beyond the dapps - Giant Waking?

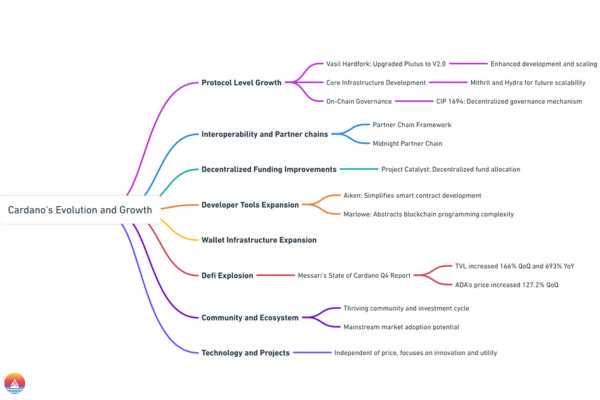

Besides projects on Cardano, it has seen much growth and evolution at the protocol level, alluding to its strength as a community and blockchain. Cardano has seen many upgrades and improvements at the technological level, which I'm going to list below. Remember that blockchain projects like Cardano are ecosystems analogous to states. Therefore, community plays a prominent role - which has, at least in my time over the past 3 years, improved tremendously from when I first entered. However, I will not touch on specific cultural points here.

Here is a list that, while including critical updates, I'm still sure misses so much.

The Vasil Hardfork upgraded the smart contract language, Plutus, to V2.0. The updates enhanced development on Cardano and were focused on scaling.

Continued development of core critical infrastructure to the future of Cardano, such as Mithril and Hydra.

Governance - CIP 1694: An on-chain decentralized governance mechanism was introduced, partly inspired by the model of the United States. It is designed to support Cardano's ecosystem growth and development by leveraging specific parameters for the community to participate in the voting on Cardano changes.

Partner chain framework and Midnight sidechain introduced: I talked about the partner chain strategy at length in Operation Midnight, but the TL;DR is that Cardano has implemented a framework for deploying a separate blockchain as part of their interoperability roadmap phase, which allows that blockchain to borrow security, use dual-token economics, and pay fees in the partner chain native token to make a robust layer 2 and sidechain ecosystem.

Cardano has continued to mature its decentralized funding mechanism with Project Catalyst, the largest decentralized fund allocator I know of.

Increased developer tools so that you do not need to use Haskel. Aiken has been created, which is meant to significantly simplify smart contract development on Cardano, and Marlowe has been rolled out, which is intended to abstract away the complexity of blockchain programming.

Cardano Wallet Infrastructure has expanded massively.

Staggering Defi results as reported by Messari's State of Cardano Q4 (e.g., Cardano's TVL increased 166% QoQ and 693% YoY, and ADA's price increased 127.2% QoQ, outpacing the overall crypto market's increase of 53.8%)

I step back and ask myself, what will draw attention to this sleeping giant? And that, I am not sure of. Every crypto cycle carries some narrative, and I think that of those narratives, whether AI, Gaming, or RealFi, Cardano has them all. I believe that the giant sleeps until so many eyes gaze upon it that it wakes.

I think there is such a thriving community at this point that it will be a self-reinforcing cycle. Those who see the price go up and look at Cardano find projects beyond impressive and innovative relative to what they've seen before, so they invest. The price goes up again, and more come to look...

Maybe it's not even related to price; maybe individuals come across big projects such as the three I've laid out above because they pick up use from the mainstream markets who could care less about blockchain-specific dogmatism or irrational attachments and decide to use what works - which Cardano will deliver.

All of this said, I'm not trying to convince you to purchase anything. I admire the technology of Cardano, Book.IO, Iagon, and World Mobile; independent of any price, the price is a nice byproduct.

I hope that even if you are repulsed at the words "blockchain" and "crypto," you can at least try to open your mind to discover what makes Cardano and these projects worthwhile, which I hope, in part, I did for you today.

Don't forget to subscribe if you're enjoying these explorations and want to continue exploring with me 🙂 - So, I want to hear from you: what do you think Cardano will do, and what are your favorite Cardano projects?

I hope you all have a wonderful week, and I'll see you in the next one.

Take care, everyone!

Dom