The Cardano Paradigm - FL#5

A New Era for Layer 1 Blockchains

Welcome to the 2 new crew members who have joined the frontier since the last post! If you haven’t subscribed, join the 18 curious explorers in our adventure to understand the frontier of innovation.

Hi, Fellow Explorers!

I hope you are doing well!

In today’s piece, I'll dive deep into why I believe Cardano will be the leading Layer 1 blockchain. This belief has held strong since my early days in crypto, and I’ve revisited it with fresh research and analysis. What follows is a comprehensive look at the unique strengths and potential pitfalls that make Cardano a standout contender.

I’ve invested serious thought and effort into this, making the longer wait for this piece worthwhile. In this deep dive, we'll unravel why Cardano's unique approach, implementation, and community could make it the blockchain to rule them all while also considering the flaws that could hold it back.

Today’s piece comes in at over 4,700 words—I hope you enjoy it :)

The Cardano Paradigm: A New Era for Layer 1 Blockchains

Blockchain technology is shaping up to be the backbone of our future digital infrastructure, offering current and theoretical benefits that are too impactful to ignore. This is a sentiment I've passionately researched for over two years and laid out in my comprehensive crypto thesis in the previous Frontier Letter. While that piece offered a broad perspective on crypto and blockchain, we explore a more specific yet equally critical narrative today.

The mainstream crypto media has become enamored with Ethereum, rendering it ignorant to all visions of the future but one: the one in which Ethereum is that future's digital cornerstone. This narrow focus risks stifling innovation and limiting public perception, making analyzing the compelling alternatives vital.

In the crowded landscape of Layer 1 blockchains, Cardano stands out. Cardano is poised to emerge as the leading programmable Layer 1 blockchain due to its rigorous peer-reviewed development approach, scalable and secure technical design choices, and committed and highly active community. This isn't just a niche technological battleground—Cardano's ascent could empower individuals with direct ownership over their digital goods, enable more secure and censorship-resilient financial access, and catalyze a new wave of decentralized applications that prioritize the individual.

I'll bring vibrant color to Cardano to substantiate this claim by comparing it with its most prominent contender, Ethereum. So let's start by setting the stage with some necessary context: What exactly is a Layer 1 blockchain, and why should you care?

The Importance of the Protocol Layer - Layer 1 Blockchains

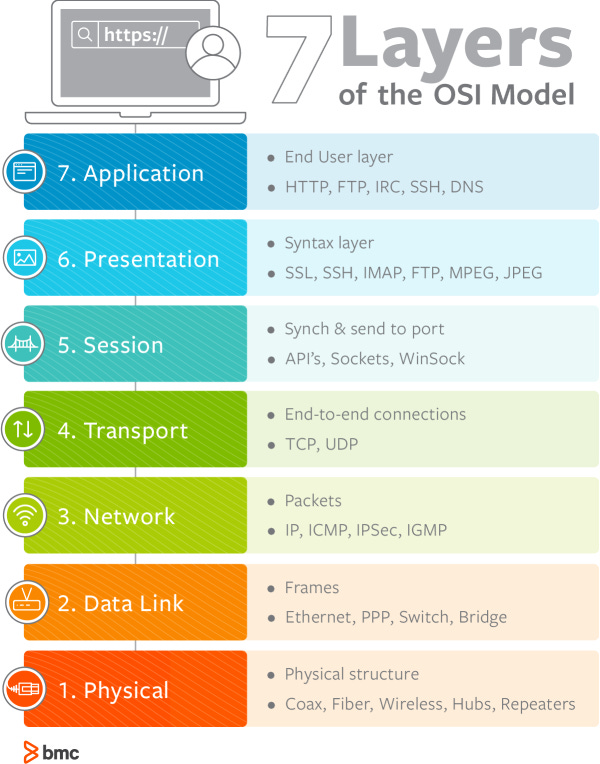

Bring to mind the latest application you opened on your phone. For me, it was Spotify. While navigating to a lo-fi writing playlist, I did not consider any technical requirements allowing me to access the app.

What wasn't either in the way of or in fulfillment of my goal, I did not think about. We are doing this constantly - look at what was necessary for Spotify to work.

I only considered the Application layer when I accessed Spotify; if the app works as expected, I don't need to think about layers 1-6. This illustrates the crucial importance of the other layers, whether you see it or not. The protocols at each layer made the web possible and created immeasurable value; however, these protocols could not capture monetary value.

Layer 1 is the foundation on which the blockchain layers are built. In the Web3 revolution, the Layer 1 blockchain will capture most of the value, increasing its relevance and importance.

Coinbase has created an imagistic model of the blockchain stack. While this is not an exhaustive landscape, it is an excellent framework for Web3 stack comprehension.

Layer 1 blockchains, also called the Protocol Layer, are the foundation upon which the rest of crypto builds. They are the record of truth for every other layer on top of them. Layer 1 blockchains provide the security, decentralization, and resources for the dapps, Layer 2s, sidechains, access layers, and use case layer projects.

The stability and security of the Layer 1 blockchain's will be as crucial as the internet's infrastructure. Yet, choosing the fitting Layer 1 is not unequivocally apparent. This is because different Layer 1 blockchains have been built with different considerations, leading to varying levels of security, scalability, and decentralization. This creates a competitive landscape where projects vie for dominance, and Cardano and Ethereum are at the forefront of this battle.

Let's dive into a comparative analysis of Cardano and Ethereum by providing context on the story of these two blockchains.

A Tale of Two Blockchains: The Ethereum and Cardano Story

Ethereum’s Story

Ethereum was the first blockchain with the idea of programmability and app development. It officially went live in 2014 and has been under development since. Ethereum is a general-purpose blockchain whose vision is to build a globally scalable, secure, decentralized internet.

The intent is to allow developers to build using Ethereum's blockchain infrastructure to inherit its great features, such as democratizing ownership over the app!

At first, it was clear that financial applications had a strong use case for such technology; however, it has evolved to what we know as Web3, which makes a strong case for most of the internet becoming blockchain-based. With a vast and expansive ecosystem and thousands of developers, the Ethereum blockchain is worth hundreds of billions of dollars and is still proliferating.

When I first became aware of blockchain and started down the rabbit hole, I used a simple app - a lottery. I set up a wallet, maneuvered $100, and deposited it into the lottery. The process took roughly 30 minutes and cost $80 before I could even enter the lottery. How could such a grand vision seem so... not grand? From there, I looked for alternatives, and there was one that did not feel like a cookie-cutter of Ethereum: Cardano.

Cardano’s Story

Cardano was founded by a former Ethereum co-founder and founder of Input Output Global, Charles Hoskinson. Charles left Ethereum to create Cardano because he had a different vision for the future of programmable blockchains.

Cardano's vision is to make a blockchain that solves the interoperability, scalability, and sustainability problems by embedding its development in peer-reviewed science and implementing it with high-assurance code (as described in the whiteboard video). I was drawn to and excited by Cardano because their objective and approach seemed well-equipped for a system that intended to become the world's record of financial and digital ownership. Such a pioneering future ideal requires commensurate care.

The vision is admiringly ambitious, the founder and team are outstanding, and the roadmap is sensible and achievable. Cardano was only a concept when I discovered it. It is now fully functional despite the "ghost-chain" narrative, has 140+ live projects, is growing an ever-expansive ecosystem, is arguably the most decentralized blockchain, and is working to become community-governed.

The design choices and community of Cardano will make it the leading Layer 1, and we are seeing glimmers of this as Cardano's ecosystem blossoms. Let's look at the approach that set them apart from the rest of the playing field!

Cardano's Ascendance - The Triple Threat: A Comparative Analysis with Ethereum

Development and Design Approach

Cardano's development approach intuitively made more sense to me than Ethereum's, especially in light of the ambitious mission each is trying to attain. However, I needed more than intuition to evaluate whether Cardano would become the superior blockchain. This journey took me to an analogous competition: Google vs. Yahoo.

This article, written by a former Google employee, outlines the importance of considering the most resilient and scalable way to build rather than fast-tracking to meet demand.

The primary takeaway, as summarized by the author, highlights an essential detail in the "war for the internet" that we can use as a comparison for the war for the decentralized internet:

"This could be a simple story about the importance of flexible architecture, but I believe the lessons here extend beyond infrastructure or application engineering and offer insight into building a sustainable business. It speaks directly to one of the most important things I've learned from my time at Google: the need to completely understand the problem before even considering the solution.

When you visualize a problem, start from scratch. Whether you're an engineer or an entrepreneur (or both), close your eyes to existing solutions and ways of doing things, ignore what has been done before, and build your ideal solution. Once you have that, you can determine which existing solutions should be used and what needs to be rebuilt."

Cardano has taken the most time to define the problem, rigorously evaluate the solution, and move toward implementation, evident by its library of 180+ research papers.

By rigorously evaluating potential solutions and anticipating future problems, you're more likely to minimize the issues you'll face down the road.

The skeptics have a point: No amount of hypothesis testing guarantees a flawless real-world execution. But in an industry of groundbreaking tech and high-stakes, where mistakes can mean severe financial losses, it doesn't seem wise to 'move fast and break things.'

The Ethereum approach is poised to project fewer potential issues, and we can see this by analyzing their roadmap. If you passively pay attention to Ethereum roughly every quarter, you would be surprised to discover that the roadmap changed at the end of 2022. The change was to solve MEV issues, posing an existential risk for Ethereum.

See for yourself.

Old Ethereum Roadmap:

New Ethereum Roadmap:

The change was the addition of the Scourge. The issue of MEV has become so impactful that a roadmap block is required for it!

Adopting a methodology similar to Cardano's might have offered Ethereum a more proactive strategy to address some of these challenges before they escalated! That's not to say they would have avoided it entirely, but it wouldn't grow into the behemoth it is.

If the goal is a global ledger of truth for digital goods, trying to ensure that you think as deeply and thoroughly as possible seems necessary.

The approach may seem like it's not very tangible to the product, so I will draw on the key design differences in this next section. While the approach comparison may seem inconsequential, it has ushered in critical design differences that will give Cardano the edge! I will attempt to dive into the core while not getting extraordinarily technical, as is the nature of some of these features.

Next, we'll delve into a foundational building block that underpins any blockchain: the consensus mechanism.

Technical Differences

Consensus Mechanism:

The consensus mechanism is the first insight into the results of the approaches dichotomy. In lay terms, a consensus mechanism is the algorithm used to agree on the content within a blockchain. Through rigorous research, the Ouroboros proof-of-stake (PoS) consensus mechanism was born (a fitting name for those familiar with mythological symbols).

Ethereum operated under a proof-of-work (PoW) consensus mechanism until September 2022, transitioning to proof-of-stake after close to a 6-year journey. Even after the "Merge," Ethereum's specific PoS implementation differs greatly from Cardano's. It has run into problems Cardano has avoided.

The most relevant example at the forefront of the conversation in the Ethereum community is the centralization risks of liquid staking protocols (Ex: 1, 2, 3).

Other equally relevant examples that give Cardano an edge are:

No slashing risks on Cardano

Non-custodial liquid staking on Cardano (mitigates the abovementioned issue)

There is no minimum limit to becoming a Cardano stake pool operator besides free market forces. In Ethereum, there is a 32ETH limit.

This infographic spells out some more differences:

The science that went into Ouroborous can be found in the IOHK research library (it's all open source). There are currently six research papers that I know of that have gone into the making of Ouroborous.

If you don't want to read six scientific research papers 😅 here are links to good explanations of the consensus mechanism.

Another foundational building block of Layer 1's beyond validating transactions is accounting for them! While seemingly minor, it has various downstream effects on the blockchain, such as contributing to the race to become the fastest blockchain in the game - so let us journey there next!

Accounting Model Compared:

A blockchain accounting model is how the records are accounted for in the system. The accounting model has repercussions on the developers and users and plays a role in the scalability of the transactions and system. The accounting model choice is fundamental to the blockchain's character and behavior.

Cardano's accounting model is eUTXO (extended unspent transaction output). Ethereum's model is an account-based global state model. Think of eUTXO as akin to cash transactions, while the account-based model is more like having a bank account.

eUTXO is made of inputs and outputs. The account model is made of an oscillating balance. Take the following example: Imagine you were on a mission to get a pack of gum that costs $5.

In Ethereum land, you can buy a pack of gum, which reduces your bank balance by $5 and increases the seller's balance by $5. In Cardano land, you have an input, a $10 bill, and two outputs: the $5 the seller keeps and the $5 you receive back for the transaction. Ethereum land uses the account model, and Cardano land uses eUTXO. Not to be confused with Bitcoin, which uses UTXO, Cardano has updated UTXO to be smart contract compatible (hence, extended UTXO).

eUTXO allows MANY different assets to be included in one transaction, opening doors for more scalable transactions. Real-world examples include NFT bundling, bundled defi transactions, and multi-invoice settlement in business transactions. eUTXO.org makes this visibly apparent. In this example, one transaction contains 164 assets, including ADA, NFTs, and other native Cardano tokens. Throw smart contract functionality in with this model, and a world not possible in Ethereum is opened in Cardano.

A 164-asset transaction might sound like it would be expensive, but here is some nice insight from the Cardano developer docs on eUTXO:

"A powerful feature of the EUTXO model is that the fees required for a valid transaction can be predicted precisely prior to posting it. This is a unique feature not found in account-based models. Account-based blockchains, like Ethereum, are indeterministic, which means that they cannot guarantee the transaction's effect on-chain. This uncertainty presents risks of monetary loss, unexpectedly high fees, and additional opportunities for adversarial behavior."

eUTXO creates a world of options for scalability, including the capability for off-chain smart contract computation, freeing up Layer 1 block space. If you would like to read the scientific paper developed for the eUTXO accounting model, I will leave it here.

With all this greatness, it comes with a trade-off: the account model makes development much easier. We'll take a look at the trade-offs Cardano faces later.

After understanding how these blockchains handle and record transactions, it's crucial to also examine how they manage their native tokens—a feature that, believe it or not, can set them worlds apart.

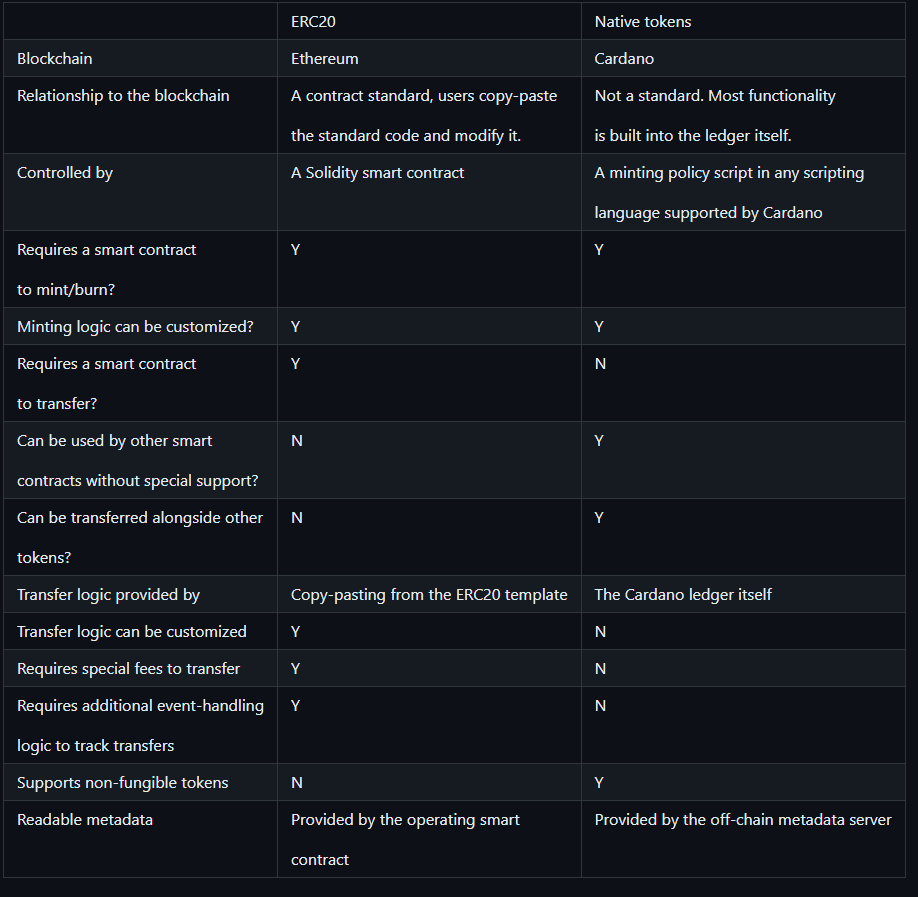

Native Tokens vs. Smart Contracts Compared:

If you decide to build on Ethereum, your token is possible through a smart contract interaction, an ERC-20 token. In Cardano's world, your token is a blockchain native token, meaning it is treated similarly to ADA. If you get an excellent idea for a fun NFT project on Ethereum, it is created as a smart contract using the ERC-721 standard; on Cardano, they are treated as native tokens.

Tokens and NFTs as native tokens make interactions safer and more straightforward and reduce future programmable complexity, given that the code is much less complex.

Native tokens are safer and more straightforward because they require less code. This not only reduces the likelihood of bugs and security vulnerabilities but also lightens the computational load.

Coupling the native token standard with eUTXO makes it possible to pay for transactions on the Cardano blockchain without even holding ADA in a concept known as babel fees. Here is a nice resource on differences in ADA, native tokens, and ERC-20 tokens.

Cardano is not short of technological differences that set it apart from the herd. So, while I've mentioned some fundamental technical strengths, I want to end this section on technical advantages by talking about a foundational decisions that sets Cardano apart.

The Settlement and Computation Layer

Settlement and computation are separate functions on Cardano. This means that accounting for value differs from the story of why the value was moved.

The settlement layer is what you will know as the Cardano blockchain, sometimes called the mainchain, the Cardano mainchain, and the mainnet. All these technologies I've been talking about (Oroborous, eUTXO, native assets) exist on this layer. It is the source of truth for the record of all transactions occurring in the Cardano ecosystem.

This decision allows for a sidechain model that will utilize the settlement layer with the capacity for custom computation models. This creates the possibility for a very secure, decentralized, and interoperable layer 1 that can have a sidechain ecosystem with many different computation models like EVM, Cosmos SDK, and privacy specific like Midnight.

This allows Cardano to focus on reliability, self-healing, decentralization, and upgradability. Not all Layer 1 solutions have chosen to separate the settlement and computation layers, including Ethereum.

Check out Charles Hoskinson's whiteboard video that unpacks the SL and CL. For a more technical angle, dcSparks' Sebastien Guillemot has excellent videos (1 and 2) that explore Cardano's architecture in depth.

That being said, Cardano's technological choices, like separating the settlement and computation layers, aren't just code written on a page; they reflect a culture that values innovation, security, and scalability. This brings us to another pillar distinguishing Cardano—its community and culture. Let's dive into how Cardano is not just winning the tech game but also building a robust and value-driven community.

Community Strength

The cornerstone of crypto is our last stop on this journey: The Community.

Ethereum has more users, developers, applications, and a higher market value. While these can be attributed to Ethereum's strong network effects, overcoming Ethereum is not insurmountable, and I think Cardano is uniquely positioned to do so.

The Best Startups Work Like Cults - Cardano Users Commitment

A formidable figure in the technology startup space is Peter Thiel. Thiel's book Zero to One provides excellent insight into creating a groundbreaking technology startup.

A memorable concept from the book discusses company culture.

Thiel makes an excellent point, and that point is: We do want startups to be relatively cult-like, but not so much so because then views will not be questioned. But a cult is preferable to consultants who don't care about the company they work for. I agree with Thiel's take on this, especially when you are operating in a space that isn't well defined; it helps to have a commitment, as a lack of definition means a higher likelihood for mistakes, which means a higher likelihood of pain, meaning need for higher pain tolerance which is typically subsided by dedicated cult-like commitment. Here is the line plot we aim for:

This directly applies to blockchain communities, as a company's culture motivates people to do work in the same sense that it does for blockchains. I think Cardano lands nearly perfectly on this spectrum. Charles Hoskinson plays a role in this with his grand vision and devotion; however, the community constantly questions him and each other - dancing around that sweet spot.

Ethereum's community is also strong, but I don't see that same commitment. While hard to measure, Charles's willingness to do open AMAs with the community and debate community members is evidence of this. A recent survey on blockchain user activity shows insight into this, demonstrating that the survey attracted more users from the Cardano blockchain than any other alternative!

From experiencing both communities, I feel that Ethereum's user base is more vast, and Cardano's is more engaged.

Ownership

A primary tenet of blockchain and crypto is an emphasis on using cryptography to foster, maintain, and retain individual sovereignty. Individual sovereignty in the digital world is increasingly apparent when we see high-profile data breaches, identity theft, and social media censorship. I'm a libertarian at heart, and my default mode of being is to reduce any overreach by institutions and maximize freedom for the individual.

Another catalyst for Cardano's community to potentially flourish beyond Ethereum's is the ecosystem's commitment to this ethos of building a system that ACTUALLY makes the individual integral to the system.

The technical design differences hint at this.

Operating a validator node on Ethereum requires a minimum of 32 ETH (~$51,000 today). Cardano has no minimum requirements.

Individuals must give up custody of their ETH to a third party to participate in staking. Cardano users keep possession, and the ADA is liquid.

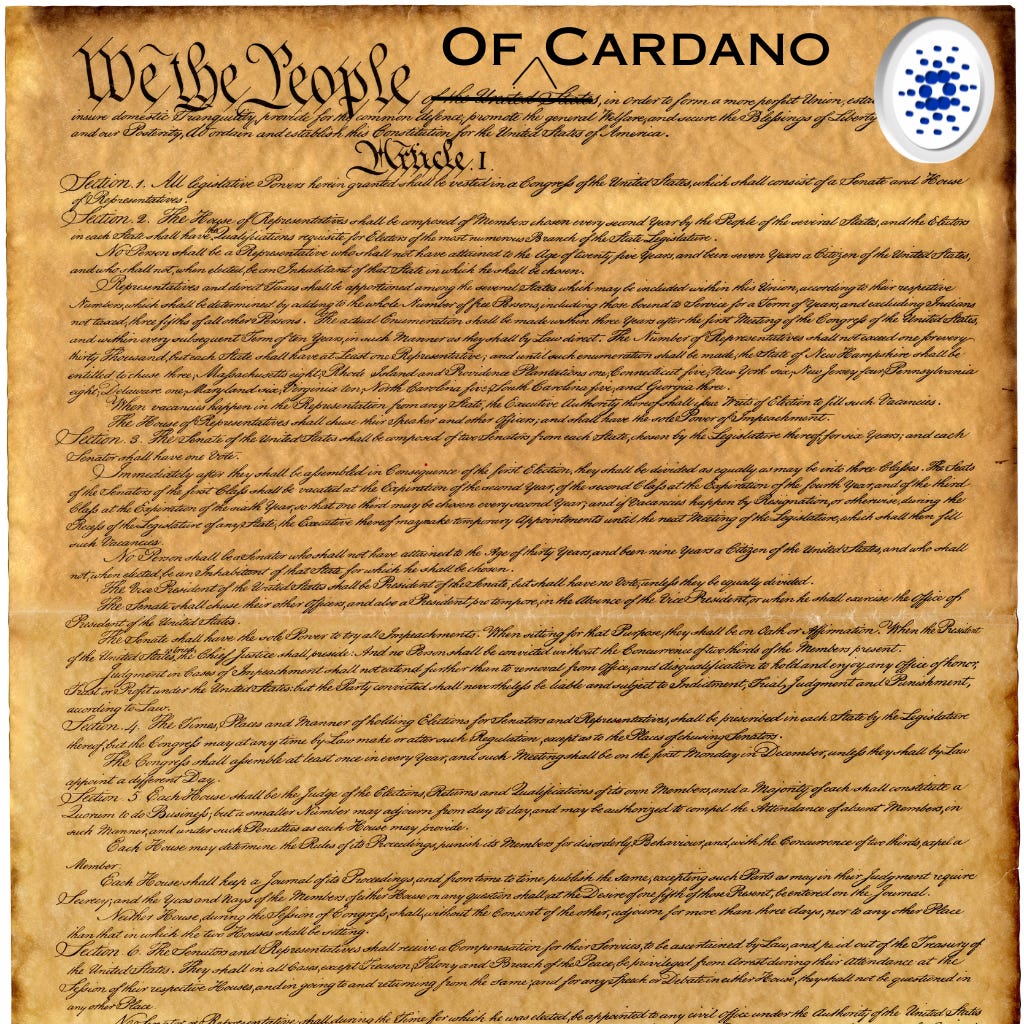

Going beyond technical demonstrations, Cardano's on-chain governance model closely mimics something like a constitutional representative democracy. This signals that the voice of individuals "living" in the Cardano ecosystem matters regardless of who you are.

This is a work in progress, demonstrated at CIP-1694, a core tenet of the governance era of their roadmap, Voltaire. Some essential aspects of CIP-1694 illuminate the path Cardano is choosing to carve on this frontier.

Firstly, everyone who owns ADA gets a vote in the future of the protocol development, and your voting power is commensurate with the amount of ADA you own. A personal favorite of mine is the concept of a delegated representative (Drep) - a registered entity to which you can delegate your voting power. I like to think of this as using ADA to vote directly on bills or giving your voting power to someone you trust.

Imagine that you could vote directly on bills in the United States. If you didn't want to, you can delegate your vote (with much more velocity than you can now).

This decentralization and individual ownership philosophy permeates the Cardano blockchain, even to funding, in Project Catalyst. Major problems facing Cardano are raised; any user can submit their team's plans to implement a solution, and the ecosystem users can vote to distribute money to worthwhile endeavors. As far as I know, this is the largest decentralized incubator engine in the world.

In comparison, Ethereum does not appear to have a process to get involved in the changes without the necessary technical knowledge. From my research, the governance for individuals goes like this: run a client and try to convince people your client is better, or submit a technical idea to the core devs.

NFT Communities

I'll keep this section concise and let the art speak for itself.

The first NFT community I was involved in was a great introduction to Cardano NFTs, as I found it a perfect representative microcosm of Cardano, mfer (link for the first NFT community I joined).

I believe NFT communities are crucial to the success of a blockchain, especially Cardano. I tend to think a hyper-rational approach will only end well when balanced with a magnificently free and engaging arts community.

The NFT communities are also core contributors to Cardano, and there are some tremendous revolutionary ideas, such as Book.io.

Okay, that's what I'll say. If you want more of the Cardano NFT community, take a wander through JPG.store and enjoy :)

Cardano's community is cultishly committed and aims to be owned, governed, and funded with the participation and direction of the community. The commitment runs through the heart of the community, which can be seen in their protocol design and NFT communities.

Cardano is no laughing matter in the blockchain space, and I hope that after digesting this, your crypto worldview is more expansive beyond the crypto mainstream narrative.

Cardano is uniquely positioned to become the leading layer 1 blockchain, and the three tenets, approach, technological implementation, and culture, will help them outcompete in the long run.

Before I wrap up, I must avoid painting a panacea. Utopian salesmen are more likely to bring dystopia, and I am not utopian (I do think I have what it takes to be a salesman, though 😛).

What follows is my deliberation of what factors will make Cardano fail if not addressed, such as the culture... wait... didn’t I just…what?

Cardano Potential Pitfalls

I believe Cardano will outcompete Ethereum, and I am optimistic that Cardano will play a vital role in the vision of web3. However, if I am wrong, it will be because the following points are not addressed.

Culture - Lack of Mainstream Integration

You may think: "Wait, you just said the community was thriving, vibrant, and committed, right?" Well, yes, but there are also cultural aspects that must be addressed to succeed. I elaborate on these aspects in my first piece, "Why is Cardano Hated?"

The piece was inspired because that question often recurred: "Why is Cardano Hated?" which I thought was an insight into the culture of Cardano.

The TLDR of that piece is that Cardano faces criticism and skepticism across crypto because of Charles Hoskinson as a divisive persona, the slow and methodical approach does not attract most retail investors, the scientific spirit in Cardano can create a level of condescension, and the 'mainstream crypto media' has done a good job of shooing people away from Cardano with the less than respectable portrayal.

The above combination has created a disfigured external perspective and a potentially resentful and spiteful one internally. I have seen A LOT less of that since I joined the Cardano community, which is excellent.

The first step in squashing the negative cultural aspects in Cardano is to follow me and share this post (Shameless plug? Yes. Delivering insight to drive change? Trying my best).

The next step toward a solution comes from the post I mentioned above:

"Take it from the legend @CardanoWhale

https://twitter.com/cardano_whale/status/1558827386283737088

So concisely, here's what we can do:

Normalize Cardano in the broad crypto market by being open to discussion with other cross-chain individuals and projects.

Let people ask ANY questions, regardless of how stupid you think it may be, and respond with grace because everyone starts somewhere, and we want that place to be Cardano.

Ensure the constitution is reflective of an open, free, and inviting ethos"

Let's spin the scientific approach from one of pretentiousness to one of radical curiosity and constant learning.

Too Slow

One can argue that the slow and methodological approach will not work in Cardano's favor.

The early release of Ethereum may have given it the necessary network effects, acting as a springboard in finding solutions to emergent problems not previously considered. Where Cardano spent time deeply deliberating, Ethereum's release speed has onboarded the necessary volume to overcome any advantages Cardano thought through early on. These network effects have granted Ethereum a larger Dapp ecosystem, more developers, and greater institutional awareness.

While I understand this argument, the difference in approach and implementation is foundational, and it will be tricky and time-consuming for Ethereum to overcome potential problems. This argument will become negligible in the next bull cycle when crypto market participants realize Cardano's Dapp ecosystem has evolved into a vast, innovative, and robust marketplace.

The protocol doesn't actually make for a better user experience.

Arguably, the protocol differences in Cardano do not actually translate to better, faster, and/or cheaper dapps. It does seem like the differences will profoundly affect the ecosystem of dapps, but they may be negligible or have the inverse effect and cause problems. An example here are the concurrency issues that emerged when Cardano first released its smart contracts. Solutions exist to this problem, but who's to say this doesn't keep happening? These concerns are valid, but I think Cardano will overcome these hurdles and bring the best web3 infrastructure.

While these challenges are significant, outlining them isn't meant to discourage but to empower the Cardano community. The first step to fixing a problem is recognizing that it is one!

Conclusion

Ethereum is by far the most successful blockchain-based internet to date. Even in the depths of the bear market, they have a daily active user count of roughly 385,330 users. It is an engineering feat and a beautiful implementation of a programmable blockchain. They have a strong community, and while they do have technical challenges ahead of them, their developer ecosystem is the largest in the blockchain development world, and they can solve problems that come their way.

However, I believe Cardano will become the world's leading layer 1 blockchain. They have committed to approaching these problems with the necessary scientific rigor and care, which has created fundamental differences that will help them win the long game. All of this is achieved while nurturing a culture that—though occasionally rocky—is dedicated to prioritizing individual prosperity.

Join the Frontier

If you've made it this far into a 4,800-word article, odds are you're as captivated by the frontier of blockchain tech as I am. To keep getting deep insights on web3, Cardano, and the intersections of technology and culture, hit that subscribe button below.

This is just the beginning. I'm committed to improving and providing more value with every article, and I'd love to have you join me on this journey.

Take care, and have a wonderful day!

Dom

Really nice write up, learned some things. Thanks!