Blockchain and Humanity: An Epic Journey from Crypto's Past to Its Potential Future - FL #4

The Technology Permeating Society and Empowering the Individual

Hi Fellow Explorers!

I hope you had a great three weeks and are doing well!

In today’s piece, I’ll be laying the groundwork and going on the journey of the vision of the future of crypto and blockchain! Along the way, we’ll dive into the history, philosophy, technical details, and all the things necessary to understand these visions.

This piece is meant to be a great first read if you’re new to this journey, and if you’ve been on it for a long time, it’ll serve as a perspective piece on where this technology goes. I went deep today - coming in at a little over 6,000 words….

I hope you enjoy reading this as much as I enjoyed writing it, and if you don’t enjoy it, well, that’s okay, as long as it did something for ya, I guess.

If this is your first time on the frontier with us, welcome aboard. Our ship currently has 15 subscribers, and I’m looking forward to adding more people to the crew!

Blockchain and Humanity: An Epic Journey from Crypto's Past to Its Potential Future

You have likely been on the internet at some point, every day, for as far as you can remember. If I had to venture a guess, that statement applies to almost every reader. In the 1980s and 1990s, only a handful foresaw the potential and reach of the internet. Fast forward from the 1990s, 3 million online users to today's staggering 5 billion – it seems like this technological revolution was obvious in retrospect, doesn't it?

The next such revolution, still in its early stage, has already started to make its mark. I think that blockchain is that technology, and while it has some maturing to do, it's an innovation so radical that it will permeate nearly every digital interaction we have and will have seemed obvious in retrospect.

Today, I will walk through what role I think blockchain technology will play in the future of our world, drawing on its use as money, as the backbone of our digital infrastructure, and as a governance tool. I will also give the devil its due and investigate what the critics believe.

As we explore the potential of blockchain, you may find and discover some opportunities that could directly impact your life. So, prepare for an enlightening journey to the frontier of tomorrow – we're about to delve into this fascinating and crazy world of crypto and blockchain!

A Brief Background On The Technical Understanding

I plunged into the Bitcoin and crypto rabbit hole and have been deeply exploring for over 2 years. Since then, I've been absorbing and processing relevant information, highlighting how it can help build a better future. Matt Levine's The Crypto Story is one of my favorite sources for understanding the technology and the most comprehensive end-to-end explanations of blockchain in a single source.

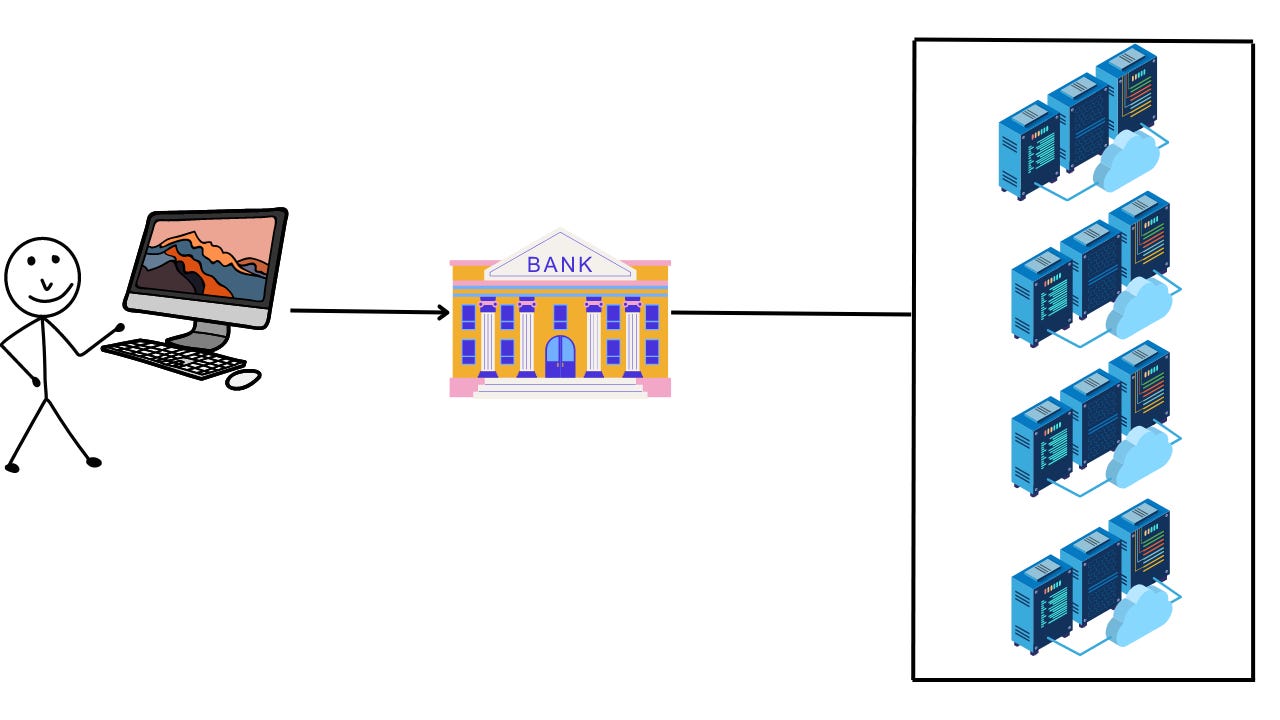

Crypto natives may consider him a "Tradefi normie," but I think he did a brilliant job objectively explaining everything about this beautifully crazy place we call crypto. Matt Levine is a Bloomberg Opinion columnist, so it does have a financial tilt. Finance is, in large part, what blockchain is being used for today. However, You'll see that it can and will be A LOT more than only finance. He starts the story in the right place - that your life's information is spread through databases. The money in your bank account, the details of your social media accounts, your important health records and blood work, the deed to your house, your insurance policies - the list can run forever.

In the case of the deed to your house - yes, you physically have a home, and your neighbors can attest to the fact that you live there. It's important to remember, though, that the reason you live there is not the deed itself but a social acceptance between you and all the parties involved that the deed is a valid representation of your ownership - which sits in a database. In some countries, this isn't a reality; the tyrants can declare your house theirs and march in and take it.

This highlights two major problems: You need to trust the keepers of the database, and you don't technically own the stuff in those databases.

Now other than the problem of trust, there is also a problem with the financial databases at banks, payment processors, and really most traditional financial institutions, which are just slow compared to the rate at which we operate digitally today (i.e., your transactions settling in 2-3 business days).

So what if there was a database that did not need to be trusted by everyone and could provide individuals with ownership over whatever they put inside of it…

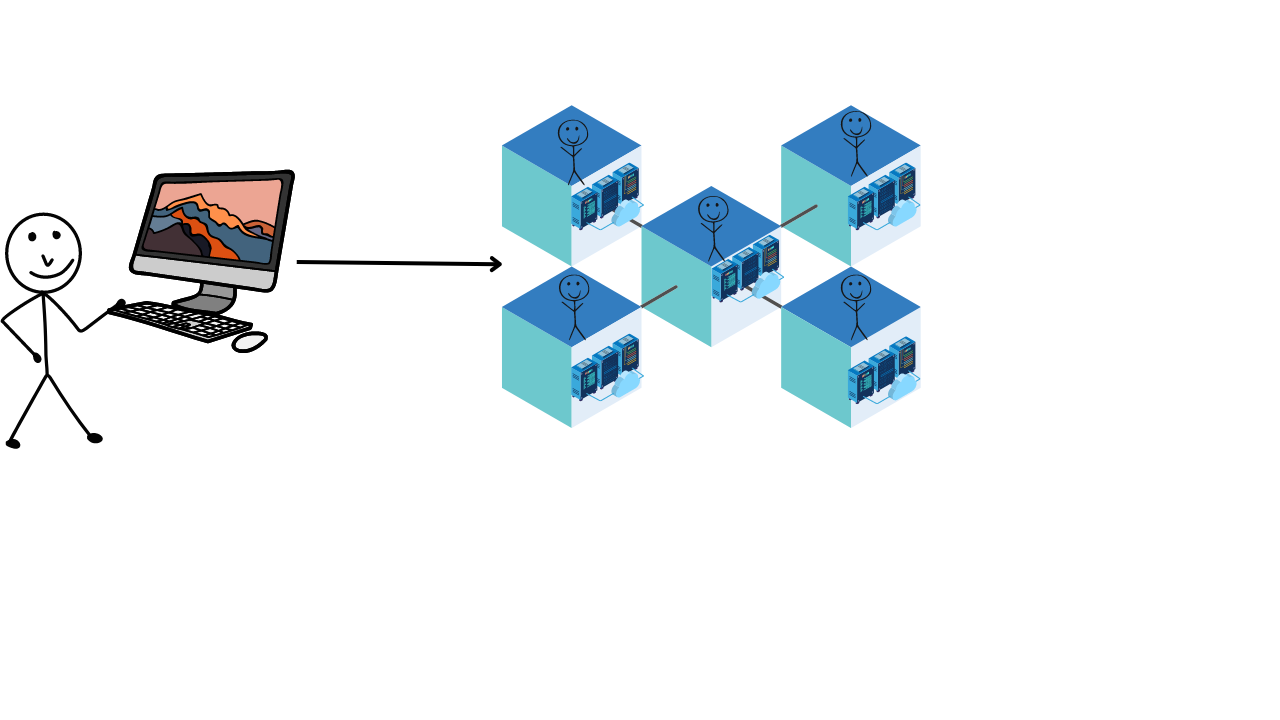

In October 2008, a pseudonymous figure, Satoshi Nakamoto, released a whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System." The whitepaper introduced a theoretical framework for blockchain technology. A blockchain is simply a list of transactions [a ledger] that is maintained by anybody who chooses to preserve the integrity of everything that is stored and processed by that ledger. Traditionally, the list is in a database, and the database owner has oversight and final say over the information in the list.

Examples are:

Entries of customer money -> Banks (JPM, BoA, Citi)

Social Media Accounts -> Social Media Company (FB, Twitter)

Health Records -> Electronic Medical Record Company (likely Epic)

Blockchains made it possible for individuals to now collectively maintain the list securely so that they could receive the security benefits of a bank maintaining this list, but you actually have full and complete control over your money (given that you hold it in a crypto wallet).

Blockchains now allow individuals to own their data and collectively validate it together - receiving enhanced security benefits and the option of ownership.

That brings me to the future of everything: Part 1 - Money.

Blockchain Technologies First and Most Apparent Promise: Money

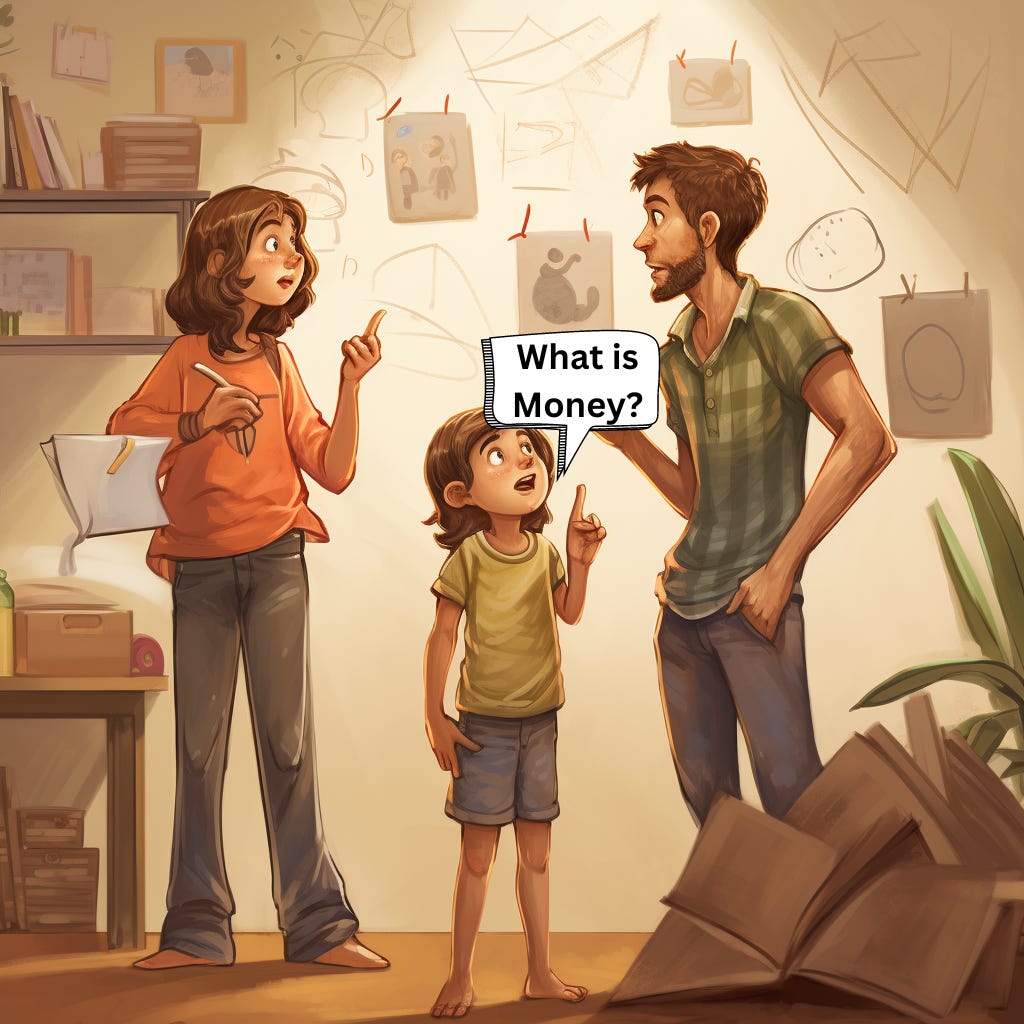

Money has always felt like this esoteric concept. It seems like there is no agreement on its definition, and I know it's in the top 3 questions parents fear their kids will ask them about.

If I had to venture a guess at most people's definition of money: "it's something you can use to buy things you need and want." Before I found Bitcoin, I used to say: "I hate money and what it does to people and their relationships," because of that, I aimed to work so hard for it. Some people say money is everything, some say money doesn't matter, and some say money is the only thing!

In some ways, Bitcoin has enforced a collective return to understanding the first principles of money! Before I tell you about Bitcoin and blockchain, we must answer the question…

This question is tricky because this tool has been part of human existence for nearly as long as humans existed! Think about that for a second; nuts! We even have evidence of money in societies almost 40,000 years ago!

Robert Breedlove is a prominent Bitcoiner and the most profound thinker on this question you will ever come across, and he has many excellent videos, podcasts, and essays on this point. At the beginning of his article, Masters and Slaves of Money,

"Money is a tool for trading human time."

Money is our time and effort, made tangible and valuable to get things we want and need. It's our time and effort crystallized into something everyone will accept, so we can buy anything we want.

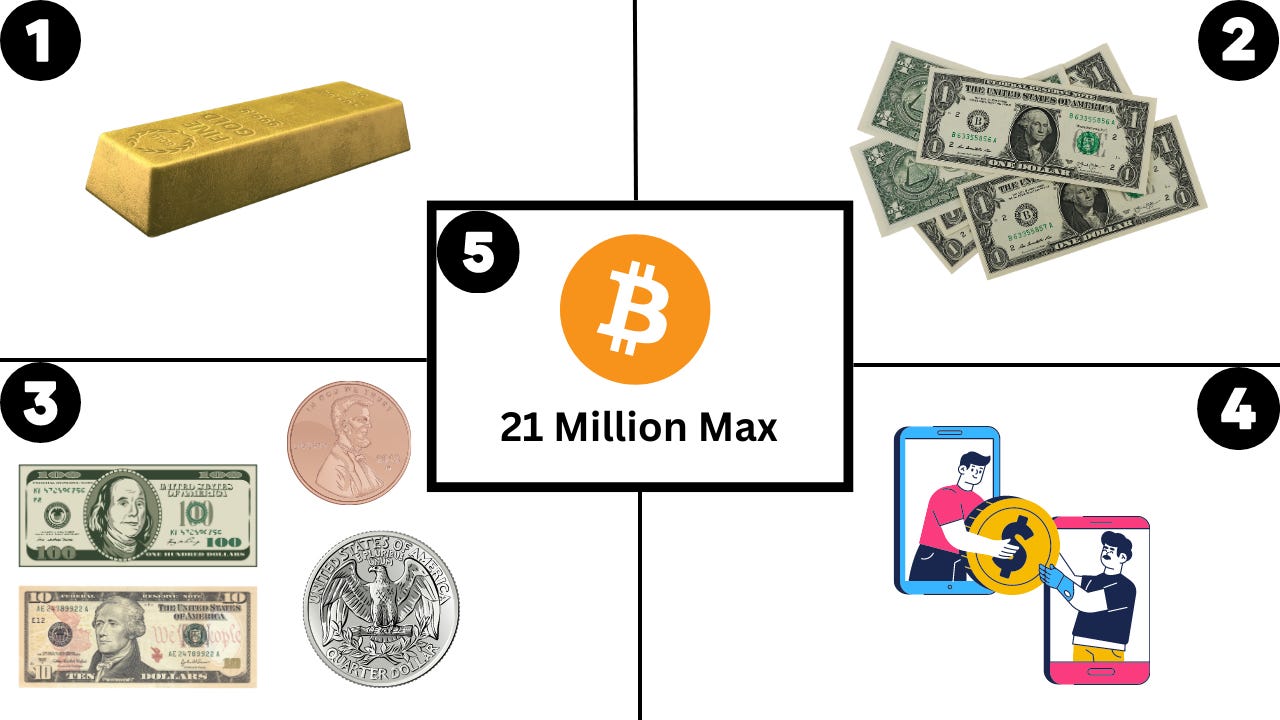

For this system to work, money must have five specific properties:

Durable - Resistant to corrosion to retain value over time

Recognizable - Authenticity can be identified

Divisible - Can be broken down into smaller units

Portable - Can easily be moved around

Scare - Resistant to an increase in supply

On top of that, it needs to serve three critical functions:

Store of value - Can preserve purchasing power over time

Medium of exchange - Universally recognized as tradeable for other things

Unit of account - Accurate price signals

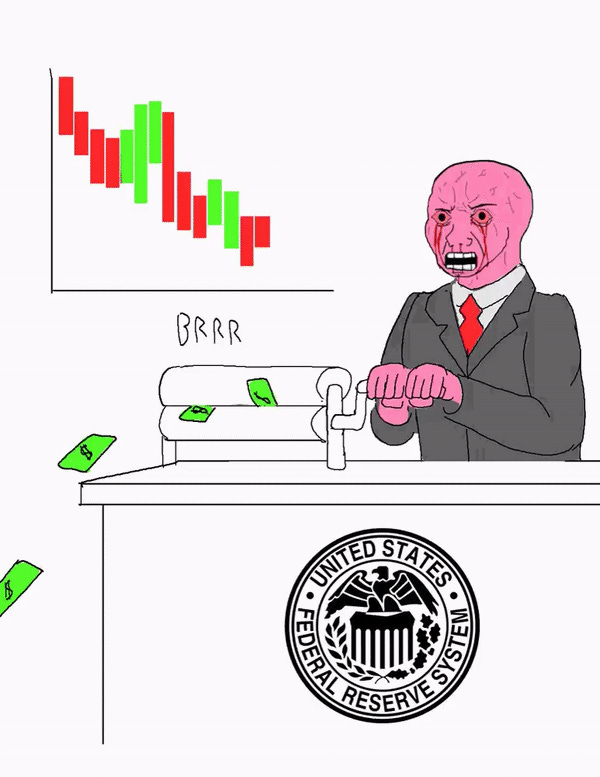

Now, ask yourself: where does our current monetary system fulfill and fail on these properties today? Are our current fiat ('by decree) monetary systems truly scarce, considering central banks can easily print money?

History of Money

With this understanding of money, here is a swift story of money in under 2 minutes or under 10 bullet points:

Home sapiens emerged 300,000 years ago.

We learned how to communicate and abstract action (thinking) together.

We found ways to make goods and services of value and needed a way to trade them.

Barter transactions emerged - but the double coincidence of wants forces the need for new ways to exchange value.

The good that holds those five properties the best is traded for most things, and that is that market's money!

Of the goods, precious metals fit these properties the best - chief of them all: Gold, because of its superior scarcity (difficult to extract > 2% of the supply a year).

The only problem is that it was not that portable… so... warehouses stored the gold and offered paper representations of your ownership of gold in their warehouse.

They turned into banks, and then central banks emerged and stored most of the gold, offering paper representations.

Paper redemptions for gold stop (also known as being taken off the gold standard), and now we operate under what they call "fiat money." Fiat only has scarcity to the extent the central bankers don't print money…

Excellent, all caught up! When I first dove into Bitcoin, this was one of the most overwhelming concepts; in some ways, crypto makes you rethink the way we're doing things, which is complicated and challenging at times, but necessary and beautiful to work through!

Bitcoins as Money

The next part of the story is where the status quo is questioned because Bitcoin is superior in all five properties of money:

Divisible - Divisible into smaller units called Satoshis (Sats). You can use it to buy a pizza and a car, all on the same day.

Recognizable - Cryptographic signatures on all transactions.

Durable - The physical degradation can only happen to the computers that mine Bitcoin; the element of difficulty coded into Bitcoin protects attacks from miners coming offline.

Portable - Can be sent around the world in close to 10-minute finality. Imagine you have a friend who lives in Italy, where banks would take several days and hefty fees; Bitcoin would take about 10 minutes with minimal fees, and all you need is your friend's Bitcoin address!

Scarce - This is on a pre-determined, programmatic release schedule estimated to reduce Bitcoin to absolute scarcity by 2140.

Bitcoiners argue that it will serve as a store of value due to its superior scarcity, you get a medium of exchange through the lightning network, and goods and services will be priced in Sats as the unit of account.

Although this presents a compelling case, it's a little more unclear in practice. I agree with Bitcoiners and envision Bitcoin as one of the greatest assets to store value.

On the medium of exchange front, the competition will be so fierce that Bitcoin will not be the leading medium of exchange. The medium of exchange will flow to the fastest, cheapest, most convenient to send and use at any given time, which currently trends to stablecoins on layer-2 blockchains.

As for the unit of account, I don't think Bitcoin will serve that function either. We will continue to price things in legacy currencies longer than I can see. Even if all nation-states fail and fiat currencies collapse, we will create a stablecoin that stabilizes to a unit of 1, so pricing and accounting are as simple as possible.

An incorruptible decentralized payment system will need an algorithmic stablecoin to work - like Djed. That is a conversation I hope to have with you all another day once djed is battle-tested beyond what Terra/Luna was.

So, as I see it, the future of our use of money will look like the following:

Store of value: In large part, Bitcoin.

Medium of Exchange: The fastest, cheapest, most convenient crypto to send.

Unit of account: Base unit of 1 on an algo stablecoin.

If you're on board with the vision, you're probably thinking: "okay got it, but everything digital is a stretch, Dom!"

Remember that blockchain is a ledger that no one can manipulate, and everyone can help control. So, brilliant people realized that there are far more use cases of what can be stored and processed on those ledgers; in fact, complex applications can be built on top of these ledgers, and the benefits received surpass what’s available on the internet today!

The Advent of the New Internet: Blockchain Beyond Bitcoin

Bitcoin's revelation sparked the idea that blockchain can revolutionize more than money. There was one issue - Bitcoin was Turing incomplete, meaning it could not run applications directly on its blockchain.

In late 2013, Vitalik Buterin released a whitepaper arguing that Bitcoin and blockchain technology needed a more robust programming language to benefit from applications to expand the use cases beyond just money. From this, Ethereum surfaced, and in July 2015, Ethereum officially launched and marked the release of a blockchain protocol in which applications can build and inherit the blockchains' strengths.

Ethereum can be used similarly to Bitcoin - the transactions on its blockchain are recorded on its ledger and decentrally verified. The critical difference is that applications can build their own project and token tied to the Ethereum blockchain. This allows people to create something that can now inherit all the strengths of a blockchain by using Ethereum as a protocol to build on top of.

The creative and visionary floodgates opened, and people came to build. Soon the idea of Web 3 emerged!

Exploring the Power and Implications of Web3

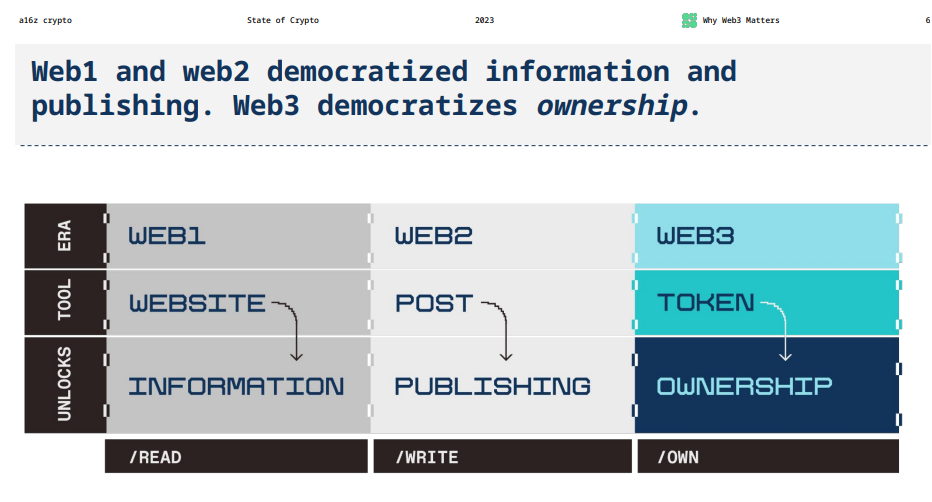

Andreessen Horowitz concisely broke these terms down:

Web 1 democratized information

Web 2 democratized publishing

Web 3 democratizes ownership

"How does it democratize ownership?" You may ask, I had the same question, and the answer is enlightening and exciting.

I love the term web3 because it indicates an upgrade from the previous version. Using blockchains as building blocks for new internet applications allows users to own their 'digital goods.' When I use that term, I mean it precisely in the same sense as when I say ownership over something physical like a basketball, silverware, a house, and a book.

Take the following example:

Upon buying a Kindle ebook, you may believe you own it. What really happens when you click "buy" is Amazon is allowing you to see a specific portion of their database's text and image for that particular book. It cannot be resold or even moved across different reader apps that may have functionality more suitable to your needs.

Blockchain enables apps to revolutionize this model, and for example, buy NFT books to store in your digital wallet. All contents in the wallet, including these digital books, are owned by YOU!

The book is now yours, and like a physical book, you can take it wherever you please. Whereas before, you were only receiving insight into Amazon's digital warehouse of books.

This example highlights some imperative attributes of Web 3. To clarify the benefits, I make it explicit below.

Implications for individuals

Web3 applications have an innate capacity for decentralization because they have open-source code, and the verification of the ledger of records is widely-disbursed. You can verify authenticity anytime, quickly pick up your entire account, and go to a different app because the

account is based on your wallet, not the information in a company's database.

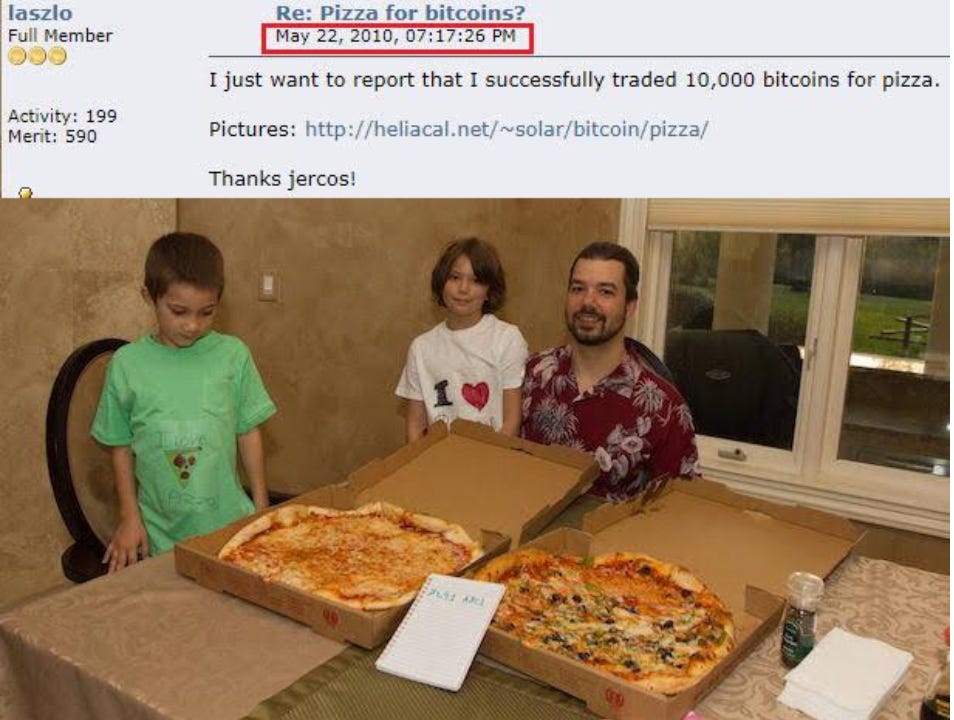

The information is written in stone; companies cannot manipulate historical data because a blockchain ledger is (well, should be) immutable. As a simple transaction, this is useful so that we don't have to trust the keepers of the ledger not to manipulate our transactions; take the example of the guy who bought two Pizza with his 10,000 Bitcoin in 2010; the ledger has not changed since and is still viewable.

An example of this utility in web3 is a finance app that provides users with the comfort that the details of interest rates will not change after it's deployed.

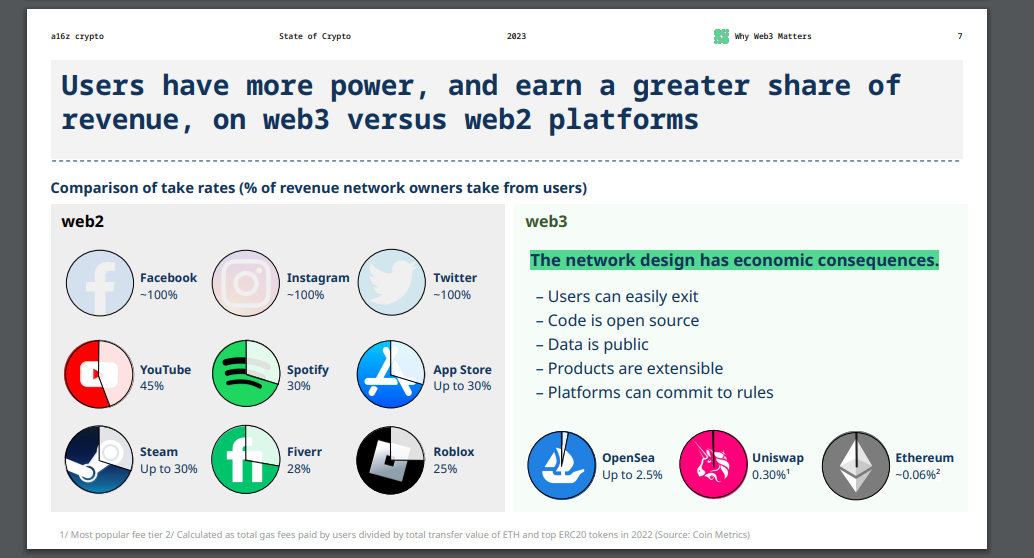

Web3 also provides individuals with ownership over the apps. This is because tokens tied to the app have models in which the revenue from the app flows to those tokens (examples here include providing liquidity on decentralized exchanges).

This means you and everyone else have a stake in the app; sometimes, the tokens are used to vote on future change and governance decisions (example of this).

Implications for Builders

Builders have the potential to unlock a more useful internet for everyone.

While the web3 market is more competitive, you benefit from emotionally connected users to these apps (both through community involvement and financial reasons)! This makes their contributions, feedback, and participation more substantial. Theoretically, this will eventually lead to more valuable long-term growth, increasing your value as a builder!

I like to think of web3 as apps forming direct or representative democracies with their users while simultaneously providing them with a financial stake!

This Harvard Review article did an excellent job of summarizing Web3:

"It's [web3] based on the premise that there's an alternative to exploiting users for data to make money — and that instead, building open platforms that share value with users directly will create more value for everyone, including the platform."

These are more than claims, and we have data to back them up:

This image from az16 crypto illustrates that web3 apps must prioritize the user first, giving them more ownership and value.

Are you still with me? Okay, cool, I know it's a lot, but if we want to understand if this blockchain on the internet is accurate, we need to dive DEEP.

Uncharted Depths of Web3

Let's take it another step deeper and talk about NFTs.

It's possible that as you read that acronym, you heavily rolled your eyes; you'll need those eyes to understand this, so I suggest you keep going.

We've talked about the digital goods that are all alike: 1 Bitcoin = 1 Bitcoin. Those are known as Fungible Tokens. 1 NFT is never = to 1 NFT. That is known as Non-Fungible Tokens (NFTs).

That's right, those pictures of the monkeys you occasionally, or often, see on Twitter. Or this stag that I may or may not own…

NFTs open up use cases for many things beyond only digital art. The question becomes - What is a unique good that can benefit from digital representation and ownership?

They could represent your deed to your house, a bachelor's degree issued in your name, a professional certification, an item in a video game, a digital book, a badge earned from winning a poker tournament, a digital avatar, a membership, and literally anything unique that would derive utility from getting digital representation!

Implementing NFTs will extrapolate beyond art, creating novel ways to think about what we can digitize.

Here are some great examples of Web3 projects highlighting much of what we've discussed today!

NOTE: I do not endorse any of these projects; I am merely helping you see the vision that I do.

Book.io - Gives you full ownership over digital Books.

NEWM - Music platform offering creators the ability to create music as NFTs to cut out intermediaries and earn more royalty revenue.

JPG.Store - Marketplace to sell digital art.

SingularityNET - AI marketplace that allows AI Agents to interact and the governance of AI decisions to be decentralized.

Indigo Protocol - Synthetic asset protocol.

UniSwap - decentralized crypto exchange.

Aave - lending and borrowing exchange.

Paima Studios - blockchain gaming engine.

The list can go on forever, and I think we'll see at least 90% of web2 have some essence of these web3 technologies I've mentioned, and that's my conservative view. Giving more value to the users is evidently a great thing!

Through the free market, we will find where individuals want blockchain implementations and where they don't!

If you are a crypto native, this vision likely resonates with you. If you are not a crypto native, I hope this help enlighten you about the potential future of the internet!

The Layer-1 Blockchain Debate: Who Will Lead The Future?

Beyond this vision, there is a further discussion: Who will be the one to implement the blockchain protocol that most people build on? The future of this question and who will dominate this market is undetermined.

The mainstream crypto opinion is that Ethereum will be the leading chain and backbone of web3, and Ethereum will interoperate with the rest of the blockchains, otherwise known as a "multi-chain future."

There is now a camp that believes Bitcoin can fulfill this purpose now that there is the BRC-20 and BRC-69 token standard.

As it currently stands, I differ from both takes because I think Cardano will play that role.

I will go into depth on this debate and elaborate on my Cardano Thesis in my next installment of the Frontier Letter, don't miss it, and make sure you have a friend to talk to about it with :)

Summary

So, as I see it, the future of our internet will look like the following:

Web 3 will allow you and me to take ownership of nearly everything digital, which is made possible by blockchain technology. It is my belief that Cardano will be a foundational piece to the infrastructure of this vision.

This is an exciting future for the internet, but allow me to take us on a visionary path that transcends the internet. Recall that blockchain decentralizes systems, makes them transparent, and enables participants to vote on change.

These benefits are great for the apps and platforms we interact with, but imagine their role in innovating an institution that can use more individual input: governments.

Evolving Governments and Political Systems

A question of humanity that has been difficult to answer forever is: What governance structure is the optimal way to organize ourselves together? Many intelligent people have debated and discussed it at extreme depth and length throughout history.

That being said, blockchain will not fix all the issues with governments. Always keep a close eye on the utopia salespeople; those who try to bring a utopia tend to manifest the opposite…

While it will only be a piece of a giant, dynamic puzzle we call government, blockchains will be a tool used to improve aspects of it. The three puzzle pieces blockchain can significantly enhance in our governments are transparency, identity, and voting.

Beyond improving our current governments, I will discuss an innovative idea that blockchain makes possible: starting our own countries!

Transparency:

Blockchain's publicly visible ledger will make all government public spending open and transparent!

Join me on this imaginative journey: a future tax system in which you can see your tax money go to the 'Federal Treasury' crypto wallet, and from there, it's transferred to a 'Grandma Sarah' with a memo of 'Social Security Payment.' This system can show you that your tax money goes to the intended use of your tax money.

It can create an open public record of the distribution of public funds to ensure that the ones in power are not lining their pockets or misusing funds because they can.

This creates an open public record you can verify without requiring the trust of a third-party auditor!

This radical transparency would make it nearly impossible for government officials to get away with the monetary misuse of public funds, creating an elevated level of accountability.

Like many areas in blockchain, this analysis makes us step back and evaluate our current mode of operation. One specific manner of operating I certainly took for granted before crypto is identity…

Identity:

Government-issued identification is a prerequisite to ownership rights in society. Whether first name/last name, social security number, or state ID, these are foundational to operation in our civilizations.

Remember that most of your digital life is in a database, including your government ID. Both with the government and the companies with that data when you sign up for their services.

Your identity can now sit in your crypto wallet alongside your Bitcoin and digital art!

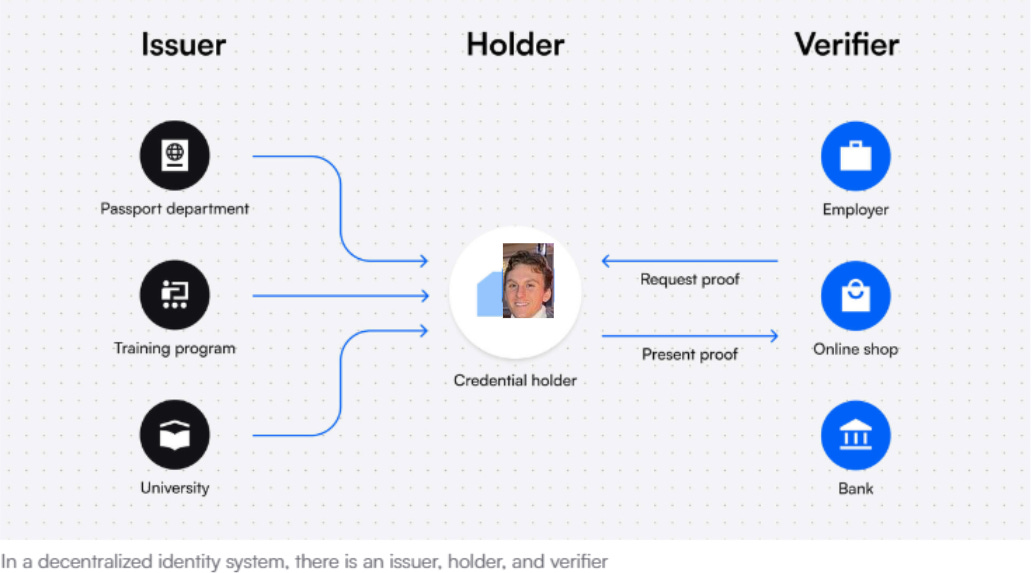

This is known as a Decentralized Identifier (DID), and it works as described in the below image:

This has many benefits, including more robust data security and reduced likelihood of identity fraud.

Your security is more robust as you can now ID yourself with your wallet and not by putting your information on a company's database.

Company data leaks won't affect you as your ID is in your wallet, reducing the likelihood of identity fraud.

Check this out for more on decentralized identity.

Beyond the modern world, blockchain can increase identification access for the nearly 1 billion people without it.

With a more resilient and safe identity system, we can use them for essential functions within a government, like voting!

Voting:

A voting mechanism on a blockchain provides the unique opportunity to make voting more accessible and easy while ensuring tamper-resistant security systems.

The details of implementation are up to the country. They can choose to allow 1 vote per digital identity. They can provide further experiments with direct democracy and allow individuals to directly vote on new bills. Cardano is currently working through an implementation that will enable users to vote on the legislation or delegate their representation to someone to vote for them, which is something of an in-between of the two examples.

The digitization of the voting system with robust security will undoubtedly make it more likely that voter turnout will increase.

Transparency, identity, and voting make for desirable potential improvements to governments; more interesting is that it's now possible to start your own country!

Far-fetched, aye? Well, not since blockchain isn't!

Network States:

Balaji Srinivasan (who you would be familiar with if you read last week's letter) introduced his cutting-edge idea of the network state.

The one-sentence definition is:

"A network state is a highly aligned online community with a capacity for collective action that crowdfunds territory around the world and eventually gains diplomatic recognition from pre-existing states."

Check out his free online book for a more elaborate definition and an exploration of these fascinating ideas.

The idea is that a digital community can now crowdfund money to buy physical land through blockchain technology! If that community becomes large, powerful, and wealthy, they can negotiate with current nation-states for their people's sovereignty. This would mean a radical transformation of the government under which we identify as a citizen.

There will likely be a transition from government implementation of blockchains to the network state taking hold.

The idea of a network state is enticing to me, as starting over has beauty to it; however, I must ask, what struggles and difficulties will come of trying to build a government from scratch? I imagine there are many struggles, but not enough to be an insurmountable feat.

A network state is a great place for someone with a dedicated following to experiment with creating a digital sovereign state with an archipelago of land. People are craving optimistic visions of the future, and I think the network state can help play into that vision.

The biggest fear of implementing blockchain into governments is its potential for misuse, and there are certainly many areas we must be on the lookout for.

Abuse?

All new technology has both its captivating upsides and its terrifying downsides. The morality of those steering matters tremendously.

Since people's identities, finances, and records can sit on the blockchain, there is a potential future in which governments can apply strict control and put limits on you.

The use of your identity and finances will be available on the blockchain, which is why the implementation matters.

On the one hand, a government can offer you privacy and apply no limits or restrictions.

On the other hand, they can ration your purchases, restrict you from goods based on your behavior, and many more second-order effects.

Take the following scenario:

Say that a government decides to track carbon outputs on the blockchain; they can programmatically set it so that when you reach a certain amount of credits, you can't buy certain goods - sort of a punishment based on what they see as wrong.

Imagine that a government calculates your carbon footprint. Above a certain threshold, your digital identity loses access to peanut butter rights. This will be a devastating revelation if you're a peanut butter fanatic like me.

A blockchain's programmatic capabilities can execute smart contracts as a punishment based on what the government views as incorrect behavior.

This is a large part of why there is pushback against central bank digital currencies (CBDCs). Even if you believe that the current group running the country won't make evil implementations of this technology, who's to say that the next group doesn't?

What I really want to drive here is that the devil will be in the details when implementing this, and we better all make sure to speak out when we see an encroachment of our rights!

In summary:

Blockchain will be a multi-faceted revolutionary tool for governments, making living situations more optimal. I think we will see it implemented over the next decade, and we should keep a close eye on it because it can be a tool for the people and simultaneously a tool for tyrants.

It can also be a tool for digital communities to put themself on the nation-state map and become their own state!

As we progress further into this new era, we must remember that blockchain, while promising, is not a panacea for all of society's ills. It is a potent and significant tool with the potential to either instill unpreceded transparency within our governments or escalate into an alarming surveillance mechanism.

It is incumbent upon us to remain vigilant. We can shape this technology to our benefit rather than succumb to its potential for control. We stand on the brink of a future where digital governments and even digital nation-states are more than mere conjecture. Therefore, let us embrace this opportunity with caution and foresight, ensuring that the blockchain revolution enhances our societies, not merely inflating our cryptocurrency portfolios.

What The Critics Say

There are bound to be people who disagree with one, two, or all three of these future visions. As far as I can see, blockchain appears to be an optimal next step for the domains mentioned above, offering promising societal advancements. However, there are reasonable criticisms that definitely have a place here.

I want to use this section to give the reasonable critic their due and discuss where this is failing and can go wrong from a critic's perspective. To do so, I'll draw on Dom from a parallel universe where I create content, but I am opposed to crypto and blockchain.

Take it away, anti-crypto Dom:

Problem 1 - The Economic Rollercoasters

Crypto historical price movement is vehemently volatile. How can you expect to be paid today and lose half your value tomorrow?

The volatility of these assets is an excellent indicator that they should not be used as money!

Problem 2 - Creating Another System of Inequality

The ownership and monetary claim of crypto and web3 is promising; however, how can you expect someone to use it when it requires such a high financial understanding and technological literacy. Crypto creates a similar flavor of the same traditional finance problem: inequality.

How do you expect someone unbanked and unconnected to adopt something complicated to use?

Problem 3 - Government's Inability to Control

Blockchain and crypto do not meld well with current central bank tooling. Economic policy is a large part of government policy, creating a problem. Economic policy initiatives cannot be effectively deployed without the ability of the central bank to control the economy via monetary policy.

Problem 4 - It's a Lawless Wasteland

There are no industry controls or rules around safe use. This causes people to lose money and lack clear operating guidance.

Problem 5 - It Looks Like Shit

Web3 looks like we're stepping back to Web1. The decentralized app's user experience and interface must improve navigation, design, and usability. On top of confusing products due to the industry's novelty, the user interfaces make it harder to grasp.

It's Dom from this universe now :) - Here's how I would respond to anti-crypto Dom:

Volatility is truth. The market swings are the collective psyche attempting to discern what is truly valuable. Out of the chaos, the order will emerge, and Bitcoin will surface as a store of value. Upon emergence, it will become less volatile. Additionally, emerging market assets tend to have the characteristic of high volatility as it is new, and the market is trying to determine their utility. Salaries can be paid in stablecoin to avoid the loss of value (or the 'unit of 1', as discussed above).

The education argument can also be leveled at traditional finance - they did a poor job educating the masses. Youtube channels and blogs are certainly helping here. The technological inequality you discuss is the same issue that existed with the early internet, but we're using it now! The demand for a user-friendly interface made it more accessible, which I think will happen with crypto. It also provides equal economic opportunity for anyone with a network connection (unless their government gets in the way). This criticism was partway why I created the newsletter and TheCryptoFrontier.

Yes, part of the appeal of crypto is that it cannot be controlled by governments and central banks, especially with the recent mismanagement of monetary and fiscal policy. If there is a better way to do something, and a government decides not to provide it to their people because it means they lose power, I believe that is an immoral act. In fact, some governments are already embracing and integrating crypto into their system; see these resources on policy in pro-crypto countries and worldwide.

Regulatory bodies are slowly rolling out their crypto policy, and some blockchain projects are working on internal governance structures to define their own rule set. Decentralized autonomous organizations (DAOs) are an example of blockchain projects playing a part in attempting to write their own rules to be as effective and safe as possible.

The world-wide-web was developed in 1980 and 1990. These protocols and websites looked different from what we use today. The protocol and infrastructure layers are being built, and the nice-looking, easy-to-use apps come next! The demand for easy-to-use and nice-looking apps and the list of criticisms about what the apps need will make it easy and quick to improve upon these.

I can continue to go back and forth with this argument here, and I recommend you do if you want to get a more in-depth view of this argument playing out.

I did it for you here using ChatGPT - 4 If you want to go deeper. Note that this is not me or anti-me; it is an AI pretending to be me.

I hope this section helped illuminate the potential downfalls of the technology. I think it will significantly impact our lives as the internet did.

Conclusion

January of 2021 was when this technology and its idea gripped me like I never was before. I was deeply cynical about our financial system and the way people were treated within that system. I saw it through my entire life, and when I found this technology, I saw a solution to so many problems.

Blockchain will not be a utopian panacea. It will not fix the world's problems, but it will play a role in creating honest money, a democratized web, and an individually sovereign nation.

It won't get built itself, and in true crypto and blockchain ethos, it's up to the committed community to help realize the potential through thoughtful implementation, responsible governance, and ongoing innovation!

Thank you, everyone, for reading the Frontier Letter; if you've made it this far, I hope it was worth it! Please let me know if you have any feedback, and drop a sub to explore the frontier together! I will have another piece out in about 2-4 weeks. The next one will probably not be over 6,000 words, but I will see where it takes me!

Until next time folks, take care!