A Quick Guide to Crypto's Use Cases - FL#18

Explain 90% of Crypto to Your Friends and Family in Less than 15 Minutes

Welcome to the 1 new crew member who has joined the frontier expedition since the last letter! If you haven’t subscribed, join the 80 curious explorers in our adventure to understand the frontier of innovative technologies as they relate to the human experience.

Cryptocurrency has taken the digital world by storm, but understanding its vastness can be daunting.

Have you ever wondered how to explain it all in just a few minutes? This guide helps you grasp 90% of the cryptocurrency market in less than 15 minutes, using only 5 categories.

I'll walk through:

Bitcoin as Digital Gold (the money use case)

Layer 1 blockchains as the people's internet

Decentralized applications (dApp) as the internet applications

Memecoins as memecoins 🐸☕

Layer 2 blockchains as the tradeoff improvement layer

More people will be drawn to the crypto market as prices continue to rise through this current market cycle.

No matter your experience level, this guide is an easy template for understanding the purpose of certain coins.

This guide provides a simple way to explain, understand, and categorize most of the crypto market, helping you know what it does and how it relates to other projects.

If you're interested in finding out what project does what better, this will make comparative analysis easier as you now have a straightforward starting point.

I hope you find this helpful in your journey! Enjoy

Bitcoin - Digital Gold

The money use case

Given that gold is traditionally the best store of value, the analogy of "digital gold" is the most apt for Bitcoin.

There will only ever be 21 million BTC. As we become more productive and create goods faster and better, Bitcoin's price will increase relative to the goods because the goods are becoming more abundant, driving the price of other goods down relative to Bitcoin's price going up.

Bitcoin is money, so it's different than simply calling it a "good" or an "asset." A good evolves as money as it is determined by the market to hold the five properties of money or is enforced via fiat (durable, recognizable, scarce, divisible, portable).

BTC holds these properties with the utmost incorruptibility - making it an amazing store of value. You can run through all of the properties of money and how Bitcoin demonstrates those properties better than any good that has ever existed here.

Most Americans (7/10, according to this survey) store their money in dollars to preserve its value over a long time frame. However, the force of inflation reduces the value of that dollar, so a significant portion of the money stored is in something that is LOSING value.

The only barrier to Bitcoin's consideration as a monetary asset was becoming socially accepted as a monetary store of value—digital gold.

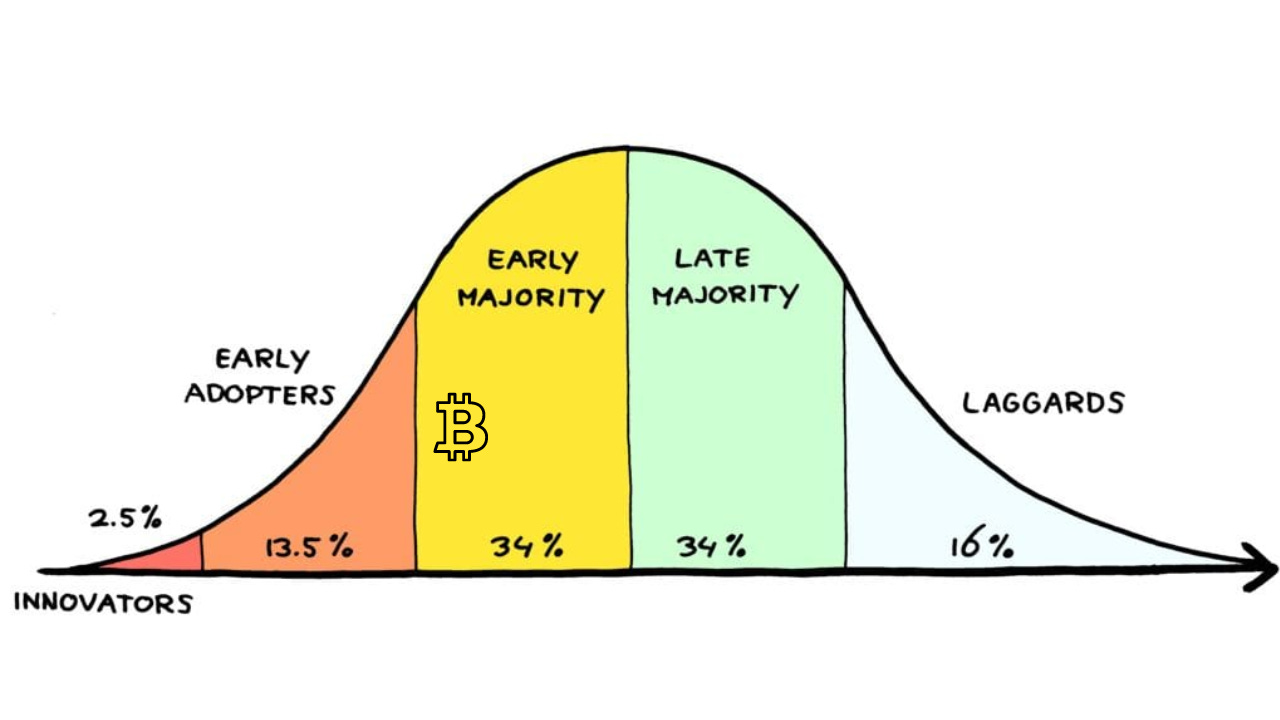

The Bitcoin ETF approval is the start of breaking down that barrier even further. With the ETF's approval, my guess is that we're somewhere at the beginning or the middle of the Early Majority, according to the Theory of Diffusion of Innovation.

Bitcoin's properties indicate it should be traded more "risk-free" since, like gold, it is money that cannot be manipulated1.

In Bitcoin's case, it's programmatically clear when the supply is released (roughly every 10 minutes) when it is cut in half (the halving every 4 years), and at what point it will become capped (estimated in 2140).

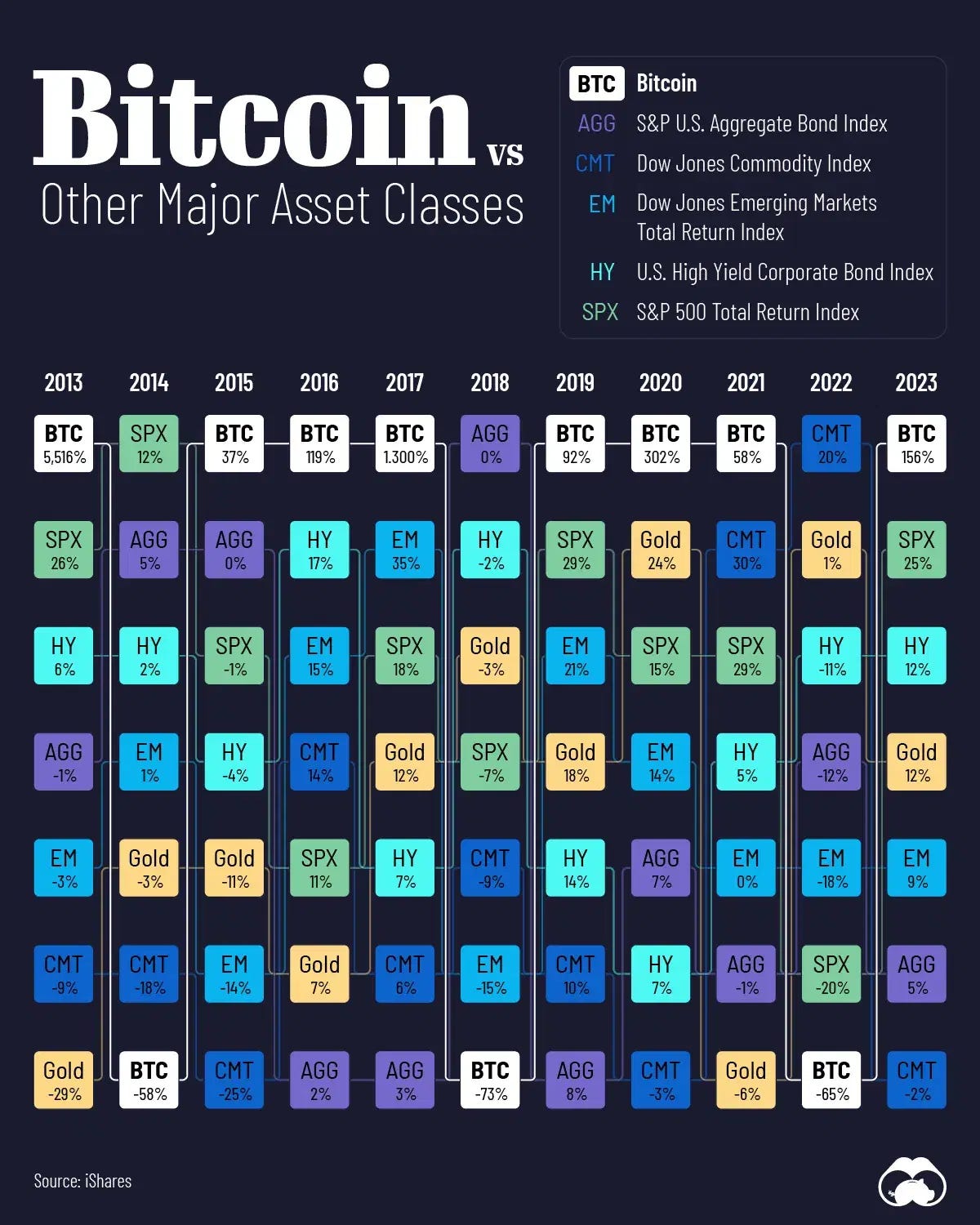

When we put things into perspective, BTC has been the best-performing asset class annually, 10 times since 2013! I do think that after it consumes the appropriate amount of the value that sits in an alternative store of value, it will trade more steadily like gold.

While I spent this section discussing Bitcoin, other currencies also compete in this section. While ADA is not 'digital gold,' it also has a predictably scarce monetary policy, which makes holding its currency desirable. ETH is disinflationary, and it is also as desirable as money. These two tokens largely fall into the next category.

BTC is at the lead of the race in this category, making comprehending the 'money' category easy. It's been around the longest, and it is the most widely accepted for what its vision was delivered as.

Examples: Bitcoin (BTC), Litecoin (LTC), Monero (XMR)

The other currencies largely fall into our next category.

'Layer-1s' - The People's Internet

The utility of 'Layer-1' blockchains is not apparent, especially for newcomers. Even in light of the Ethereum ETF approval, I don't believe the mass market understands why it's worthwhile.

Upon grasping the abstract concepts, the uses aren't immediately apparent. Cointelegraph writes, "While Bitcoin is often marketed as "digital gold," Ethereum hasn't quite found its simple elevator pitch yet, according to crypto analysts."

Bitcoin is digital gold, Ethereum is …. digital… stuff?

It's not culturally clear yet what layer 1 blockchains do. Sure, people like myself, and I'm sure other crypto innovators and early adopters who have been in the game for a while, know why it can be valuable and what the great potential is—but most people don't.

The mass market will ask: What problem does it solve for me, and what does it do differently that I can't already do? Most people jump to the vision as the selling point, but the mass market will first be drawn to the products that solve their problems.

For Layer-1's - I think we're still in the early adopters area for layer-1s.

From reading Simon Sinek's It Starts With Why, I learned that the early adopters and innovators come because of a great visionary idea—layer 1s have that down (well, the good ones like Cardano do).

For example, I came to Cardano with the dream of a decentralized internet, state, and nation, completely community-governed and owned, with an incorruptible associated currency ($ADA). No one could take my stuff or tell me I couldn't own that stuff—I have it, and it's encrypted in MY wallet. If this is going to be a competitor for the digital infrastructure of THE WORLD, then we should try our best to embed everything we do in peer-reviewed science, take a methodological approach, and develop software using formal methods in the same way they would when building rocket or nuclear software, etc.

I preferred Cardano to the alternatives because their approach seemed the most reasonable.

Now, people can select other chains for other specific tradeoffs that those chains made. There are 'so many' of these because each is architected and optimized differently.

As Layer-1 moves into the broader market, communicating the product becomes necessary. Vision still plays a role, but the vision should be embedded in the product's technical implementation.

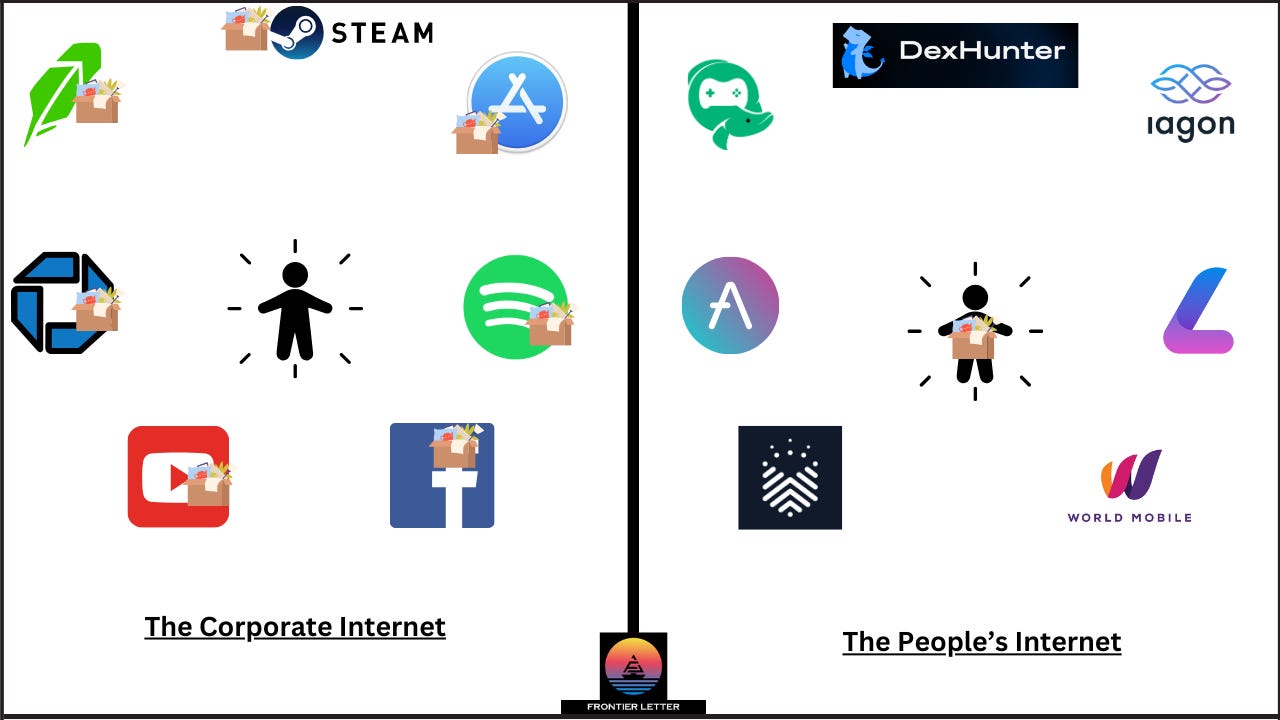

The primary use case of Layer 1 is the creation of the ownership internet.

Where the current internet is run by corporations who are the gatekeepers of all your stuff, in the crypto internet, you hold all your stuff and bring it where you go, which is why this layer is referred to as the people's internet.

Technically speaking, you log in with a username and password to access your stuff on the corporate internet.

On the people's internet, it's stored in a wallet that goes everywhere you go.

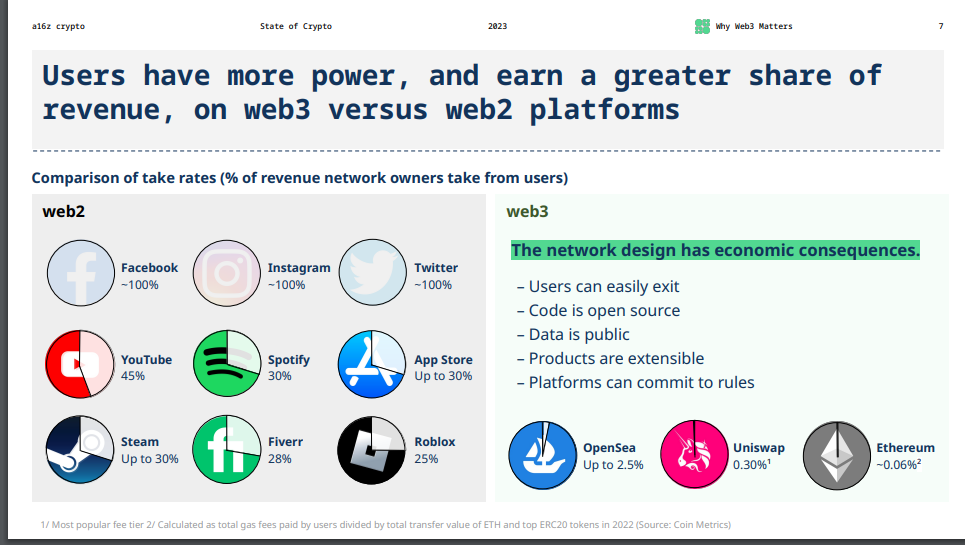

From an ownership perspective, you can have a financial stake (buying tokens) and voting rights (governance tokens), and the money extracted from users is significantly less - meaning it's much cheaper to use and saves you money!

Here's an excellent showcase of this below from AZ16 Crypto:

Author of Read Write Own: Building the Next Era of the Internet, Chris Dixon, writes (Bolding my doing):

"I see the history of the internet as unfolding in three acts, each marked by a predominating network architecture:

In the first act, the "read era" (circa 1990-2005), early internet protocol networks democratized information. Anyone could type a few words into a web browser and read about almost any topic through websites.

In the second act, the "read-write era" (roughly 2006-2020), corporate networks democratized publishing. Anyone could write and publish to mass audiences through posts on social networks and other services.

Now, a new type of architecture is enabling the third act of the internet. This architecture represents a natural synthesis of the two prior types, and it is democratizing ownership. In the dawning "read-write-own era," anyone can become a network stakeholder — gaining power and economic upside previously enjoyed by only a small number of corporate affiliates, like stockholders and employees."

This cycle will test crypto's vision accrual, and the mass market will be quite surprised (especially in Cardano) to find there's far more to crypto than talk. The different chains that make the people's internet have associated currencies that make for great money as well (as noted - $ADA)

Examples: Cardano (ADA), Ethereum (ETH), Solana (SOL), Polkadot (DOT), Avalanche (AVAX), Cosmos (ATOM)

The next category is a building block on the people's internet - it's our applications!

dApps' - The internet applications

Once you grasp the concept of Layer 1 as an internet YOU own, most of the other tokens that exist are applications built on that infrastructure.

So, for example, Book.io is an application that uses the Cardano blockchain to make ebooks and audiobooks so that you can own your own digital books to not only read but to lease and borrow to people - you actually own the digital good; hence, the people's internet.

Book.io competes with Amazon in the ebook market, which gives you access to their application, which holds your purchase (more on book.io here).

Uniswap and Aave are financial applications built on Ethereum.

When you consider people's internet as something you own, it becomes easier to see how a crypto internet application differs from a corporate internet application.

If using a credible Layer-1, you will, at minimum, have the assurance of true ownership, but you should also have the privilege of less fees, more movement flexibility, voting rights, and a financial stake.

Examples: Book.io (BOOK), IAGON (IAG), World Mobile (WMT), Axo Trade (AXO), DexHunter (HUNT), Aave (AAVE), Uniswap (UNI), Decentraland (MANA)

Memecoins

Memecoins are tokens built on people's internet but don't typically have a specific application; they're a currency that exists on the layer 1 blockchain with a culture built around it.

I tend to look at meme coins as a price signal on a unit of culture (memetics theory w/ a price signal).

Examples: Snek (SNEK), Dogecoin (DOGE), Shiba Inu (SHIB), PEPE (PEPE), Bonk (BONK)

Lastly, we have layer 2s.

'Layer-2s' - Tradeoff improvement layer

As you research more deeply, you'll hear 'layer 2' used frequently. This is a blockchain that utilizes a layer 1 blockchain for some of its features but improves the tradeoffs that the blockchain made.

For example, where Ethereum chose security at the cost of speed, chains like Optimism and Arbitrum are layer 2s that still 'use' Ethereum for their security but improve transaction speed and fees.

So, while you can directly tap into Ethereum to navigate the people's internet, you can partially inherit its safety but reduce your fees by using its extension - layer 2.

Examples: Optimism (Ethereum L2), Arbitrum (Ethereum L2), Loopring (Ethereum L2)

Conclusion

Understanding the various facets of the cryptocurrency market can be overwhelming, but breaking it down into these five categories simplifies the journey. Whether you're a newcomer or a seasoned enthusiast, this guide provides a solid foundation for exploring the dynamic world of crypto.

If you're intrigued by the intersection of innovative technology and humanity, you've found a welcoming community here. Whether you're new to this or a seasoned enthusiast, we're all here to learn and grow together.

By subscribing, you become an integral part of our journey on the frontier. Your engagement is not just welcomed but highly valued. Don't forget to invite your friends, family, and coworkers to join us on this exciting adventure.

Which category are you most excited about and why?

Looking Forward

It's arguable that the monetary functionality of some of the Layer 1 blockchain tokens is better than BTC, and Bitcoin can arguably end up being a stronger internet layer than others (I don't currently think so). Additionally, protocols such as Cardano and Ethereum that provide the necessary infrastructure for the people's internet have more benefits than only the ‘people's internet.’

However, this serves as a simple entry point for understanding most of the crypto market as it stands.

If you want depth of understanding, here is my first-principles deep dive into blockchain. Here is my deep dive thesis into Cardano and why it looks to me to be the superior layer-1. Here is my deep dive into why the Cardano ecosystem will be the best and three apps it currently has that already allude to its greatness.

I will continue to investigate Cardano and its ecosystem, a question I am currently exploring: How can we use blockchain to efficiently and effectively organize a community toward collective action that can compete with modern companies?

Have a lovely week - I'll see ya in the next one!

Dom

Technically, there can be software changes in something called a software fork. However, Bitcoin's culture vehemently opposes these.